Advertisement|Remove ads.

RingCentral Stock Dips As Weak Guidance Spooks Investors: Retail Sentiment Flips To Bearish

RingCentral, Inc. (RNG) shares slipped in Friday's premarket session after the cloud-based communications software and services provider issued below-consensus guidance despite reporting a beat for the fiscal year 2024 fourth quarter.

The Belmont, California-based company reported fourth-quarter adjusted earnings per share (EPS) of $0.98 versus $0.86 for the year-ago quarter. The bottom-line result was a penny ahead of the consensus estimate and edged past the $0.96-$0.97 guidance range.

Revenue climbed 8% year over year (YoY) to $615 million versus the $612.42-million consensus estimate and the guidance of $611 million to $613 million.

Subscription revenue rose 8% to $590 million, accounting for 96% of the total revenue. The guidance was for $587 million to $589 million.

RingCentral’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) improved YoY to $153 million from $138 million. The adjusted EBITDA margin also expanded to 24.9% from 24.2%.

Among the operational metrics, annualized exit recurring subscriptions (ARR) rose 7% YoY to $2.489 billion, slower than the 9% growth in the third quarter. Enterprise ARR increased by 7%. The company said it won more than 30 deals that were over $1 million in total contract value in the fourth quarte

Vlad Shmunis, RingCentral's founder and CEO, said, “Our new AI-powered products are gaining steam.” He also noted the unveiling of the RingCentral AI Receptionist, or AIR, on Thursday.

The AIR artificial intelligence (AI) phone agent uses generative AI (GenAI) to automatically answer customer questions and transfer callers to the right place,

CFO Abhey Lamba said RingCentral achieved GAAP operating profitability for the first time in 2024.

RingCentral also announced the elevation of Chief Innovation Officer and CMO Kira Makagon to the post of President and COO, effective immediately.

The company expects to generate nearly $600 million in operating cash flow in 2025.

RingCentral guided adjusted EPS in the range of $0.93-$0.97 for the first quarter and $4.13-$4.27 for the fiscal year 2025. The guidance trailed the consensus estimates of $1.01 and $4.22, respectively.

The company expects $607 million to $612 million in revenue for the quarter and 4%-6% revenue growth for the full year. Analysts, on average, expect $627 million in revenue for the quarter and 8.9% revenue growth for the year.

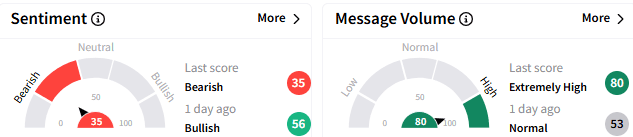

On Stocktwits, sentiment toward RingCentral stock flipped to ‘bearish’ (35/100) from ‘bullish’ a day ago. The message volume perked up to an ‘extremely high’ level.

In premarket trading on Friday, RingCentral stock slid 5.75% to $29. The stock has lost over 12% this year.

For updates and corrections, email newsroom@stocktwits.com

Read Next: CarGurus Stock Slides After Mixed Q4 Results, Weak Guidance: Retail Mood Worsens

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_vertex_logo_resized_4070318817.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)