Advertisement|Remove ads.

Rivian, Lucid Stocks Slide As Team Trump Reportedly Eyes EV Tax Credit Axe: Retail Turns Shaky

Rivian Automotive, Inc. ($RIVN) shares on Thursday lost gains from the previous session that came on the back of Volkswagen’s bumped-up financing as part of their partnership.

The slide followed a Reuters report that revealed President-elect Donald Trump’s transition team is planning to eliminate the $7,500 electric-vehicle tax credit that the Biden administration currently allows.

An energy-policy transition team led by founder of Continental Resources Harold Hamm and North Dakota Governor Doug Burgum, has begun deliberating on the roll back of the subsidy, the report said, citing two sources.

The discussions are in alignment with Trump’s statements during his election campaign.

The transition team reportedly believes the EV tax credit could easily be passed as part of a larger tax reform bill in a Republican-controlled Congress. That said, some of Biden’s clean-energy policies provided through the Inflation Reduction Act of 2022 may be tough to repeal, given money has already been allocated for the programs and that they are popular.

EV manufacturers, including Tesla, Inc. ($TSLA), have benefited from Biden’s largesse, especially amid the tough industry environment marked by dwindling demand and increased price competition.

Tesla is relatively better positioned in the eventuality of Trump making good of his promise. The company’s scale of operation and production efficiency could help observe any losses stemming from a dent to demand.

The same is not true about smaller peers including Rivian and Lucid Group, Inc. ($LCID), which are burning oodles of cash on each vehicle they manufacture.

Rivian, in its third-quarter earnings report, revealed that it lost about $39 million per EV it made.

As of 2:52 pm ET, Rivian shares were down 10.97% to $10.71 while Lucid lost a more modest 2.09 to $2.14.

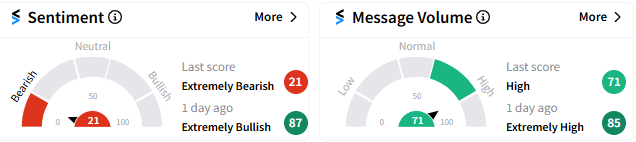

Rivian’s steep pullback has drawn the attention of the retail crowd as it was among the top five trending stocks on Stocktwits.

The sentiment meter on Stocktwits showed an ‘extremely bearish’ (21/100) mood toward Rivian stock, reversing from an ‘extreme bullish” stance seen a day ago. Message volume tapered off but remained ‘high.’

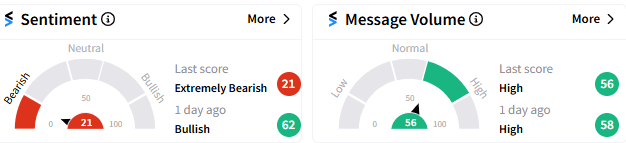

Retail’s disposition toward Lucid was equally bad, as it turned ‘extremely bearish’ (21/100), accompanied by ‘high volume.’

Read Next: Applied Materials Analysts Wary Of 2025 Outlook Ahead Of Q4 Results: Retail Rallies Behind The Stock

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)