Advertisement|Remove ads.

Applied Materials Analysts Wary Of 2025 Outlook Ahead Of Q4 Results: Retail Rallies Behind The Stock

Semiconductor-equipment maker Applied Materials, Inc. ($AMAT) is scheduled to report its fourth-quarter results after the market closes on Thursday.

Analysts, on average, expect the Santa Clara, California- based company to report non-GAAP earnings per share (EPS) of $2.19 on revenue of $6.96 billion.

Applied Materials’ non-GAAP EPS and revenue were at $2.13 and $6.71, respectively, in the year-ago period. The company’s guidance issued in mid-August called for non-GAAP EPS in the $2-$2.36 range and revenue of $6.93 billion, plus or minus $400 million.

An earnings call hosted by the management is scheduled for 4:30 pm ET.

Earlier this week Stifel and Susquehanna lowered their respective price targets for Applied Material shares, the Fly reported.

Stifel reduced the price target from $270 to $250 and Susquehanna took it down from $190 to $170. The former has a "Buy" rating on the stock and the latter has a "Neutral rating."

Commenting on the imminent quarterly results, Stifel said it expects the fourth-quarter results and the forward guidance to meet or modestly exceed the consensus estimates. The firm said it would focus on the company’s commentary on China revenue.

In the third quarter, the company derived 79% of revenue from Asia, with 32% of that coming from China.

Stifel reduced its calendar year 2025 estimates due to muted expectations for wafer fabrication equipment (WFE) growth.

Susquehanna analysts echoed a similar sentiment as they expect a beat-and-raise quarter but remained wary of 2025. The firm expects 2025 WFE spending to decline 2% year-over-year in 2025.

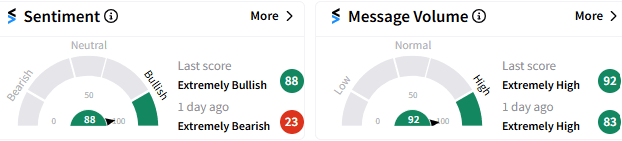

Retail sentiment inflected higher, turning from ‘extremely bearish’ a day ago to ‘extremely bullish,’ (88/100) and activity levels also remained ‘extremely high.’

Applied Materials shares bucked the broader market pullback on Thursday and was seen trading up 1.79% at $186.07 as of 12:50 pm ET. The stock has gained about 13.4% for the year-to-date period, underperforming the Invesco QQQ Trust ($QQQ), which is up over 25%.

Read Next: SPY, QQQ Dip After PPI, Jobless Claims Data: Retail Turns Neutral As Focus Shifts To Powell’s Speech

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)