Advertisement|Remove ads.

Rivian Stock Draws Retail Buzz As Volkswagen-Backed EV Software Platform Set For Winter Testing Next Year

- RV Tech reported steady progress on its scalable EV software platform, with winter testing across VW, Audi, and Scout models set for early 2026.

- Volkswagen said future EVs will use Rivian’s zonal architecture, with the ID. EVERY1 planned for production in 2027.

- Stocktwits users pointed to Rivian’s broader tech potential and noted the timing window created by Tesla's Model Y refresh ahead of the R2 launch.

Retail chatter spiked around Rivian on Wednesday after the company and Volkswagen Group released updated details on the first-year progress of RV Tech, their joint venture developing an EV electrical and software platform that Volkswagen has said it needs to compete with Tesla and Chinese rivals.

Platform Designed For Scalability

RV Tech said it has made solid progress on the EV electrical and software platform and is focused on delivering models for both companies. The JV said it is also keeping communication open with third parties about the scalability of its platforms, Bloomberg reported.

Rivian’s software chief and RV Tech co-chair Wassym Bensaid said the JV is “solving a problem for the larger automotive industry” and said this “could become an opportunity” for other companies. He added that potential earnings from licensing the technology would have “a very different margin profile” compared with manufacturing vehicles.

The platform is designed to scale across multiple vehicle sizes and segments in Western markets.

Winter Testing Planned For 2026

RV Tech said winter testing will begin in the first quarter of 2026 on Audi, Volkswagen, and Scout models. Volkswagen separately said its electric models from Volkswagen, Audi, and Scout Motors would begin winter testing in the same period to assess performance in extreme cold conditions, according to a report by EV.

Volkswagen added that prototypes of the ID.1 compact EV are already undergoing testing at RV Tech facilities in Palo Alto and Irvine, California. The ID.1 is expected to be the first Volkswagen model to debut the new software, with production targeted for 2027.

Volkswagen Confirms Use Of Rivian Architecture Across Future EVs

Volkswagen confirmed it will adopt Rivian’s zonal architecture and software stack for its future EVs. The Scalable Systems Platform (SSP) is expected to be deployed across up to 30 million vehicles across multiple Volkswagen Group brands and price segments.

The joint venture combines engineers and software developers from both companies and uses Rivian’s centralized electronics layout with fewer computing units, which Volkswagen said is intended to simplify development and lower costs.

Model Rollout Timeline

The first vehicle to use the new platform will be Rivian’s R2 SUV, set to debut early next year. Volkswagen’s compact EV, the ID. EVERY1, expected to cost around 20,000 euros, will follow in 2027, with additional Scout-branded vehicles after that.

Stocktwits Traders Point To Tesla Parallels

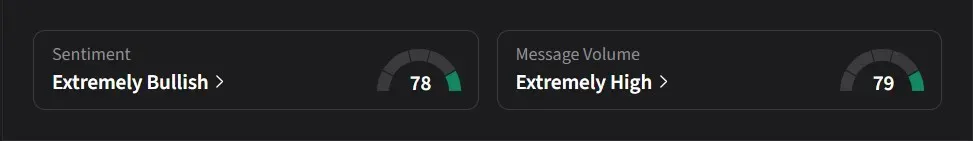

On Stocktwits, retail sentiment for Rivian was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the Volkswagen–Rivian update changed how they viewed Rivian, noting that Volkswagen may apply the joint technology to gasoline models as well as EVs. The user added that many still view Rivian only as a carmaker, but said they believe the company’s role could extend beyond that, drawing a comparison to how some investors describe Tesla.

Another user said Tesla’s recent Model Y refresh, which took place before Rivian’s R2 launch, could benefit Rivian, arguing that it gives the company an opening to add more features to the R2 to help differentiate it.

Rivian’s stock has risen 32% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tom_lee_OG_2_jpg_9ae5c049c3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)