Advertisement|Remove ads.

Crown Castle Stock In Spotlight After Q1 FFO Tops Estimates, Retail’s Bullish

Crown Castle (CCI) stock is expected to draw retail attention on Thursday after its first-quarter adjusted funds from operations (FFO) topped Wall Street’s estimates.

The communications-focused real estate investment trust (REIT) reported adjusted FFO, a metric used to gauge the profitability of REITs, of $1.10 per share, while analysts had expected it to post $1.02 per share.

Houston-based Crown Castle owns, operates, and leases more than 40,000 cell towers in the U.S.

However, the company reported a net loss of $464 million, or $1.07 per share, for the three months ended March 31, compared to a profit of $311 million, or $0.71 per share, in the same period a year earlier.

The loss was tied to the sale of its small cells and fiber solutions businesses for a total of $8.5 billion, as Crown Castle aims to become a pure-play U.S. tower firm.

The company launched a strategic review of its assets in December 2023, following an activist investor's push for changes, citing the stock's underperformance.

Its site rental revenue fell 5% to $1.01 billion, hurt by Sprint cancellations related to the T-Mobile-Sprint network merger.

"We delivered solid operational and financial results in the first quarter, as a continuation of strong activity levels in the U.S. drove 5% organic growth in our tower business, excluding the impact of Sprint Cancellations,” interim CEO Dan Schlanger said.

The company said that President Donald Trump’s tariff policies would not impact its full-year 2025 outlook and reiterated its prior forecasts.

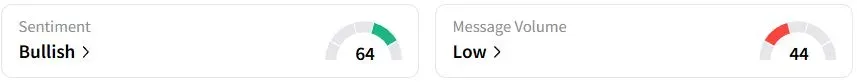

Retail sentiment on Stocktwits was in the ‘bullish’ (64/100) territory, while retail chatter was ‘low.’

Crown Castle stock has risen 16.5% year to date (YTD).

Also See: Allstate Stock Slips As Q1 Profit Halves On California Wildfire Losses, Retail’s Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)