Advertisement|Remove ads.

Robinhood Stock Eyes Record Highs As Assets Under Custody Balloon To Over $200B: Retail Stays Buoyant

Robinhood Markets, Inc. (HOOD) shares rose nearly 1% on Friday, moving toward record highs, after the company reported January operating metrics that revealed a rise in funded customers and assets under custody.

Funded customers at the end of the month rose to 25.5 million from approximately 310,000 in December 2024 and up approximately two million on a year-over-year (YoY) basis.

At the same time, assets under custody (AUC) almost doubled to $204 billion compared to the year-ago period. On a sequential basis, AUC rose 6%

Net deposits came in at $5.6 billion, translating to a 35% annualized growth rate relative to December 2024. The company said that over the last twelve months, net deposits stood at $52.3 billion, translating to an annual growth rate of 51% relative to January 2024.

Robinhood’s equity notional trading volumes rose 144% YoY to $144.7 billion during the month. Options contracts traded rose 57% YoY to 166.6 million, while crypto notional trading volume grew 200% YoY to $20.4 billion.

Some of the other metrics include:

- Margin balances at $8.3 billion, up 131% YoY.

- Total Cash Sweep balances at $26.3 billion, up 57% YoY.

- Total Securities Lending Revenue at $25 million, up 108% YoY.

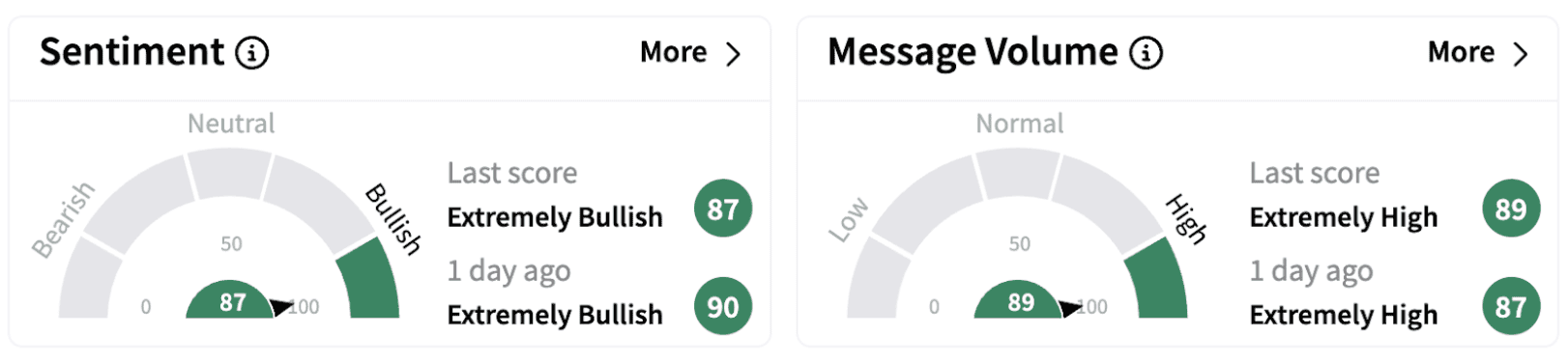

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory.

On Thursday, Robinhood reported a billion dollars in quarterly revenue for the first time.

Revenue rose 115% year-over-year (YoY) to $1.01 billion during the fourth quarter compared to a Wall Street estimate of $951.79 million. Earnings per share (EPS) came in at $1.01 versus an analyst estimate of $0.45.

The company reported a net income of $916 million during the quarter, including a $369 million deferred tax benefit, primarily from the release of the company's valuation allowance on most of its net deferred tax assets. It also includes a $55 million benefit from a reversal of an accrual as part of a regulatory settlement.

HOOD shares have risen over 63% in 2025 and have gained over 381% in the past year.

Also See: Nano Nuclear Energy’s December-Quarter Losses Widen: Retail Sentiment Sours

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altimmune_jpg_8f251e2911.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)