Advertisement|Remove ads.

Rocket Lab Stock Dives 10% After Bleecker Street Discloses Short Position: Defiant Retail Couldn’t Care Less

Shares of Rocket Lab USA Inc. (RKLB) tumbled over 10% on Tuesday after Bleecker Street Capital disclosed a short position on the stock.

Bleecker Street said Rocket Lab has materially misled investors about the likelihood that its Neutron rocket will launch in mid-2025. “In fact, rocket experts we spoke to put the timeline of a rocket launch from mid-2026 to mid-2027, a one to two year delay,” it said.

Rocket Lab is in the process of launching Neutron, a medium-lift rocket that the company hopes will compete with SpaceX’s Falcon 9.

Bleecker Street cited documents and 23 interviews with industry experts, including former Rocket Lab engineers and executives, to say that many aspects of RKLB’s Neutron program are far behind where they need to be, from engine development to engine and structure production, launch pad construction, and rocket transport to the launch site.

“With a 2026 or 2027 Neutron launch, it appears RKLB won’t be able to onboard for a year or more to its most lucrative single source of potential contracts, National Security Space Launch’s (NSSL’s) Phase 3 Lane 1 program,” it said in its report.

The firm also highlighted that a revenue shortfall in the face of continued cash burn is a liquidity threat for Rocket Lab, which had $504 million in the bank as of September.

“Three aerospace executives with rocket development experience estimated it will cost RKLB between $300-$600 million to finish and launch Neutron to profitability, meaning RKLB will need to raise money to fund Neutron and survive,” it said.

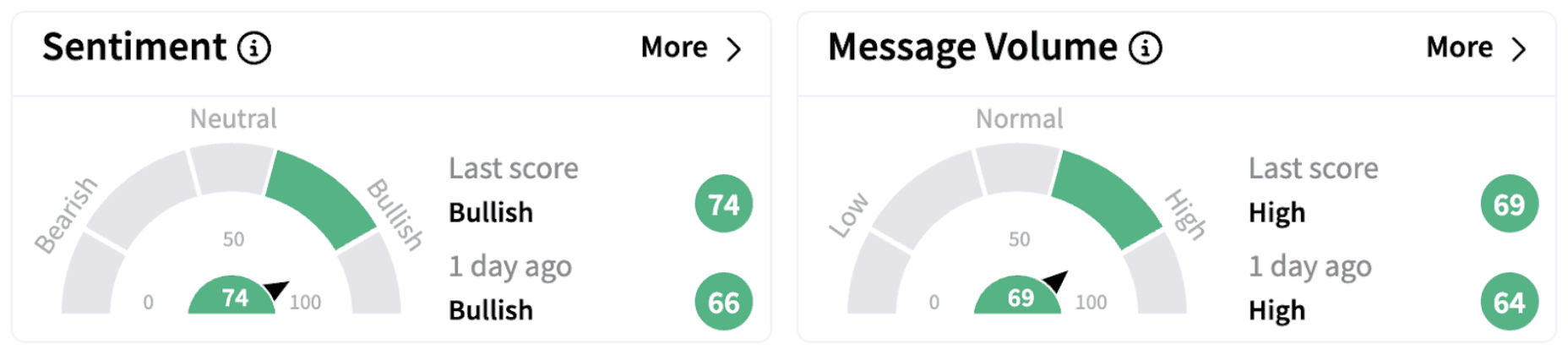

Meanwhile, on Stocktwits, retail sentiment defied the stock price decline, climbing further into the ‘bullish’ territory (74/100). Retail chatter also increased simultaneously.

Despite the negative report, defiant retail investors expressed optimism about the stock’s prospects.

Rocket Lab is scheduled to report its earnings after the closing bell on Thursday. Wall Street expects the company to report a loss of $0.07 per share on revenue of $130.57 million, according to FinChat data.

With Tuesday’s decline, RKLB shares have lost over 19% this year but are still up over 341% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)