Advertisement|Remove ads.

Bank Of America Reportedly Calls BGC ‘Most Overlooked Trump Trade In Diversified Financials’: Stock Up But Retail’s Unimpressed

Financial services company BGC Group Inc. (BGC) shares shot up over 7% on Tuesday morning after Bank of America initiated coverage of the stock with a ‘Buy’ rating and a $16 price target – implying a 72% upside from the stock’s current level.

According to a CNBC report, Bank of America analyst Eli Abboud said BGC is the most overlooked Trump trade in diversified financials.

The analyst believes that under the Trump administration’s preference for deregulation, the company’s trading offerings – including the new FMX Futures Exchange – stand to benefit.

“Despite BGC trading down post-election, we think an eased regulatory backdrop significantly accelerates FMX Futures’ ramp while the new administration’s agenda (bank deregulation, deficit spending, foreign policy) benefits trading volumes,” Abboud wrote in a note, according to the CNBC report.

The analyst also noted that the company’s rates futures trading is a $2 billion opportunity that’s “ripe for disruption” and can even win market share from the CME Group as it modernizes futures trading.

Recently, the company reported its fourth-quarter (Q4) earnings, which saw its revenues rise 10.8% year over year to $572.3 million. Its brokerage revenue rose 11.8% to $516.1 million.

Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) rose 26.7% to $192 million, while net income rose to $25.20 million compared to $19.95 million during the year-ago quarter.

For the first quarter, the company expects to report revenues of $610 million—$660 million and pre-tax adjusted earnings of $145 million—$161 million.

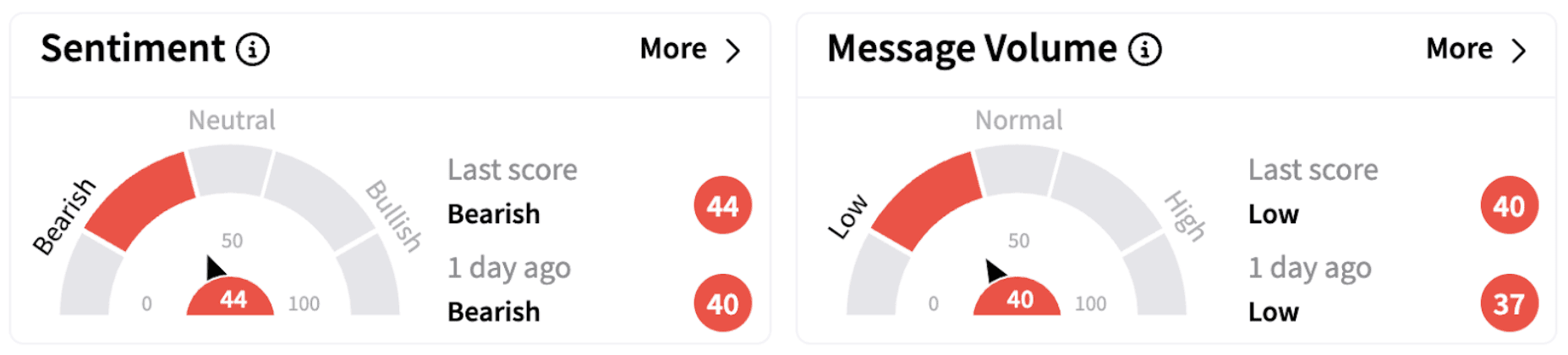

Meanwhile, on Stocktwits, retail sentiment inched higher but still trended in the ‘bearish’ territory (44/100).

BGC stock has lost nearly 0.11% this year but is up over 33% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)