Advertisement|Remove ads.

It’s Raining Price Target Hikes For Rockwell Automation After Strong Q1 Earnings: Citi Expects 16% Upside From Current Levels

Rockwell Automation Inc. (ROK) received a slew of price target hikes from analysts on Tuesday after the company reported stronger-than-expected first-quarter earnings and a jump in orders.

Citi raised the firm's price target on Rockwell Automation to $350 from $345 while maintaining a ‘Buy’ rating on the shares. The price target implies a 16% upside potential from current levels.

According to The Fly, Citi believes the company started fiscal 2025 "on a solid footing," with improvements across both order trends and execution.

The brokerage also noted that improving operational performance and a greater focus on cost discipline and productivity actions should continue to support the company’s margin.

Rockwell Automation’s sales declined 8% year-over-year (YoY) to $1.88 billion, aligning with a Wall Street estimate. Adjusted earnings per share (EPS) came in at $1.83 versus an analyst estimate of $1.58. Net income fell 14% YoY to $184 million during the quarter, primarily driven by lower sales volume.

The company also reported a 10% YoY rise and a mid-single-digit sequential rise in orders.

Meanwhile, Wells Fargo analyst Joseph O'Dea raised his price target on Rockwell to $337 from $315 while maintaining an ‘Overweight’ rating.

The brokerage highlighted the company’s sequential order improvement and solid margin performance versus expectations.

Barclays, too, raised its price target to $300 from $285 while keeping an ‘Equal Weight’ rating on the shares. The brokerage believes the stock is unlikely to underperform in the early stages of a cyclical upturn but said the valuation "means we struggle to justify major upside.”

Rockwell CEO Blake Moret stated in his remarks that Q1 margins and EPS came in well above the company’s expectations and that the company is encouraged by better-than-expected order performance in the quarter, with sequential growth across all regions and business segments.

“While there is still some macroeconomic and policy uncertainty weighing on customers’ capex plans, Rockwell won multi-million dollar strategic orders across key industries, especially in the U.S., our home market,” he said.

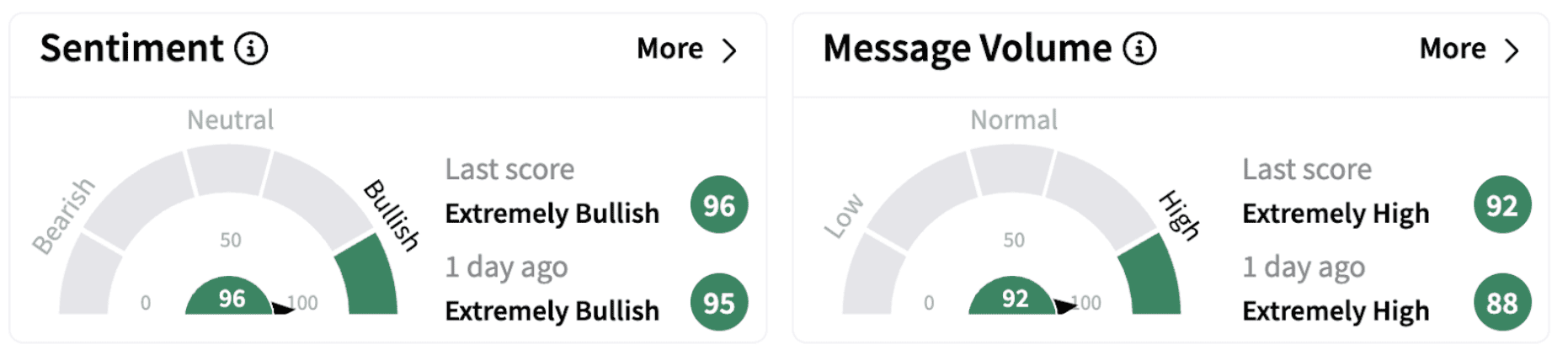

On Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (96/100) accompanied by significant retail chatter.

Rockwell shares have gained over 7% in 2025 and are currently hovering near year-high levels. The stock has risen nearly 8% over the past year.

Also See: Leidos Holdings Stock Rises Pre-Market On Upbeat Q4: Retail Stays Enthusiastic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)