Advertisement|Remove ads.

Rockwell Automation Stock Heads For Best Single-Day Gains In 2.5 Years After Upbeat Earnings, Order Jump: Retail’s Exuberant

Shares of Rockwell Automation Inc (ROK) surged over 9% in Monday’s pre-market session, set for their biggest single-day gain since July 27, 2022, after the company reported better-than-expected first-quarter earnings and a jump in orders.

Sales declined 8% year-over-year (YoY) to $1.88 billion, aligning with a Wall Street estimate. Adjusted earnings per share (EPS) came in at $1.83 versus an analyst estimate of $1.58. Net income fell 14% YoY to $184 million during the quarter, primarily driven by lower sales volume.

The company reported a 10% YoY rise and a mid-single-digit sequential rise in orders.

Segment-wise, Intelligent Devices saw a 13% decline in sales to $806 million, while Software & Control saw sales falling 12% YoY to $529 million. However, Lifecycle Services sales rose 5% YoY to $546 million.

Rockwell Automation has revised its sales outlook for 2025 to approximately $8.1 billion compared to a previous guidance of $8.2 billion. Reported sales growth is expected at -5.5% to 0.5% compared to a previous forecast of -4% to 2%.

CEO Blake Moret said Q1 margins and EPS came in well above the company’s expectations and that it is encouraged by better-than-expected order performance in the quarter with sequential growth across all regions and business segments.

“While there is still some macroeconomic and policy uncertainty weighing on customers’ capex plans, Rockwell won multi-million dollar strategic orders across key industries, especially in the U.S., our home market,” he said.

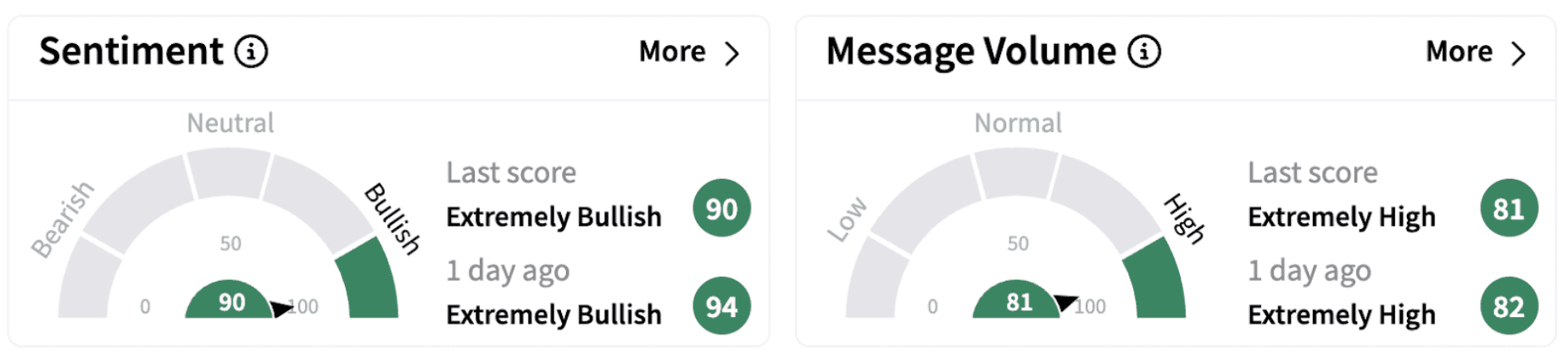

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory (90/100), remaining at a year-high level. The move was accompanied by an ‘extremely high’ message volume.

One Stocktwits user expressed concern over the revised sales outlook.

Rockwell shares have lost over 4% in 2025 and the past year.

Also See: FactSet Stock Rises On $246.5M Acquisition Of LiquidityBook: Retail Enthusiasm Soars

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)