Advertisement|Remove ads.

Palo Alto Networks Stock Slides Despite Q2 Beat, Strong Guidance: Retail Not Interested In ‘Panic Selling’

Palo Alto Networks, Inc. (PANW) shares fell in Thursday’s after-hours session despite the cybersecurity company’s fiscal year 2025 second-quarter beat.

The Santa Clara, California-based company reported second-quarter adjusted earnings per share (EPS) of $0.81 and revenue of $2.3 billion, up 14% year over year (YoY).

The results exceeded the consensus estimates of $0.76 and $2.27 billion, respectively. The guidance issued in late November modeled adjusted EPS of $0.77-$0.78 (split-adjusted) and revenue of $2.22 billion to $2.25 billion.

The reported net income was $1.7 billion or $2.44 per share, which included a $1.5 billion net tax benefit.

CEO Nikesh Arora said, “In Q2, our strong business performance was fueled by customers adopting technology driven by the imperative of [artificial intelligence] AI, including cloud investment and infrastructure modernization.”

He noted that platformization drew the company’s quarterly results, with strength seen in next-generation security (NGS) annual recurring revenue (ARR) and remaining performance obligations (RPO).

NGS ARR climbed 14% YoY to $4.8 billion, exceeding the guidance of $4.70 billion to $4.75 billion. However, the growth decelerated from the 40% pace in the third quarter. RPO climbed 21% to $13 billion versus the guidance of $12.9 billion to $13 billion, with growth accelerating from the third quarter’s 20%.

Palo Alto expects third-quarter adjusted EPS of $0.76-$0.77 and revenue of $2.26 billion to $2.29 billion, compared to the consensus estimates of $0.76 and $2.27 billion.

The company guided NSG ARR growth of 33%-34% and RPO growth of 19%-20%.

The company nudged up its fiscal year 2025 revenue guidance to $9.14 billion—$9.19 billion from $9.12 billion—$9.17 billion. It also guided adjusted EPS to $3.18-$3.24.

The bottom-line guidance was above the estimated $3.17, while the revenue guidance surrounded the $9.15-billion consensus estimate.

It looked forward to NGP ARR growth of 31%-32% and RPO growth of 19%-20%.

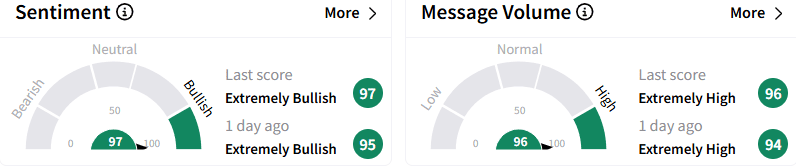

On Stocktwits, sentiment toward Palo Alto stock remained ‘extremely bullish’ (97/100), the highest in about a year, and the message volume stayed ‘extremely high.’ The stock was among the top ten trending tickers on the platform late Thursday.

A watcher called upon fellow retailers not to resort to panic selling, calling the quarterly performance a ‘good beat.’

Another user said the post-earnings sell-off is a typical development seen after each of the past 14 prints. They see the stock rising by over 10% from the pre-earnings level.

In the after-hours session, Palo Alto stock fell 5.10% to $191.59. The stock has gained about 10% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)