Advertisement|Remove ads.

TeraWulf’s Power Portfolio, HPC Optimism Drives Roth Capital’s Ambitious Price Hike

Roth Capital has considerably raised its price target for TeraWulf Inc. (WULF), boosting it to $21.50 from $14 while reaffirming its ‘Buy’ rating and citing strategic portfolio reassessment as the core driver for the upgrade.

The firm noted that the price target increase stems from a refreshed sum‑of‑the‑parts analysis that now captures TeraWulf’s existing high‑performance computing (HPC) colocation agreements with Core42, Fluidstack, and Alphabet Inc.’s (GOOGL) (GOOG) Google, along with projected expansions at the Lake Mariner interconnect and Cayuga power sites, according to TheFly.

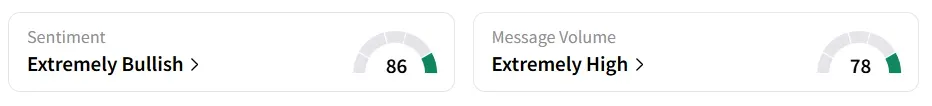

TeraWulf stock traded over 6% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock experienced a 154% increase in user message count in 24 hours as of Friday morning. A bullish Stocktwits user highlighted Google’s backing of TeraWulf.

In August, TeraWulf secured two long-term agreements with Fluidstac, a cloud platform that builds and operates HPC clusters for global enterprises. Under the 10-year contracts, TeraWulf will deliver over 200 megawatts (MW) of high-density IT power at its Lake Mariner campus in Western New York.

Google has agreed to provide a $1.8 billion backstop on Fluidstack’s lease commitments, helping facilitate debt financing for the buildout. In exchange, the search giant will receive warrants to purchase roughly 41 million shares of TeraWulf, giving it an estimated 8% equity stake.

TeraWulf’s stock has been in an upward swing, gaining in value every month since April, with August seeing a whopping 83% surge.

TeraWulf stock has gained over 264% in the last 12 months.

Also See: AST SpaceMobile Stock Hits All-Time High As Investor Interest Around Its Partnerships Surges

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)