Advertisement|Remove ads.

Route Mobile Reversal In Sight? Breakout Above ₹1,200 Could Change The Game: SEBI RA Rajneesh Sharma

Route Mobile is showing bullish reversal signals after undergoing a prolonged period of correction.

The stock has fallen by over 60% from its 2021 all-time high of nearly ₹2,300, but recent price action suggests that exhaustion may be setting in, according to SEBI-registered analyst Rajneesh Sharma.

Route Mobile stock has found repeated support in the ₹850 - ₹900 range, forming a strong long-term base, and the price is now inching closer to a key multi-year downtrend resistance zone.

Technically, several bullish reversal signals have emerged, Sharma noted. A clear OBV (On-Balance Volume) bullish divergence is visible, with prices making lower lows and OBV making higher lows, indicating quiet accumulation.

The relative strength index (RSI) also shows a bullish divergence, with the indicator rising toward 50 on the weekly chart despite falling prices, often a sign of shift in momentum, the analyst said. An increase in volumes further supported the bullish case.

Sharma said that the ₹1,150 - ₹1,200 area now serves as a critical resistance zone. This range aligns with long-term trendline resistance, and a weekly close above ₹1,200 would confirm a breakout.

At the time of writing, Route Mobiles shares were trading at ₹1,012.90.

Fundamentally, Route Mobile remains strong. The company maintains a net cash position of ₹8,918 crore and zero long-term debt. It has over 3,200 clients across more than 20 countries and has recently launched an AI-powered SMS protection system and a conversational commerce platform.

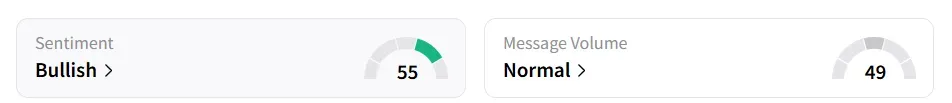

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago.

The stock has shed over 27% of its value year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)