Advertisement|Remove ads.

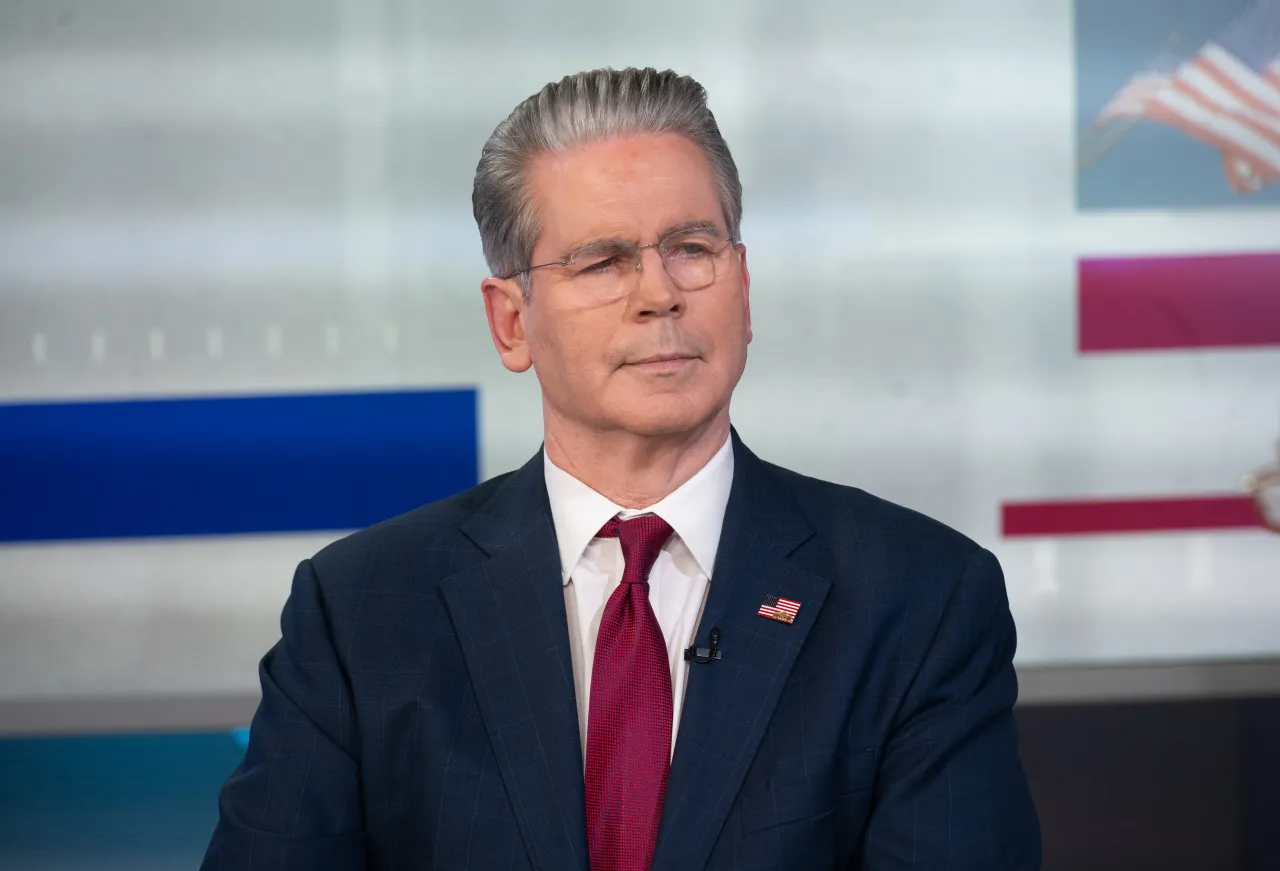

Scott Bessent Reportedly Says Government Shutdown Could Hit US GDP: 'This Isn’t The Way To Have A Discussion'

U.S. Treasury Secretary Scott Bessent on Thursday said that the government shutdown could hit the gross domestic product (GDP) of the United States.

“This isn’t the way to have a discussion, shutting down the government and lowering the GDP. We could see a hit to the GDP, a hit to growth, and a hit to working America,” Bessent said during an interview on CNBC on the second day of the shutdown.

He also criticized Democratic leaders for forcing the government shutdown, calling Senator Chuck Schumer and Representative Hakeem Jeffries “weak” and “discombobulated.” “They don’t represent the American people, and you know they’re making up excuses,” Bessent said in the interview.

The U.S. GDP rose at an annualized rate of 3.8% in the second quarter (Q2), and it is projected to grow at the same rate in the third quarter (Q3) as well, according to the Atlanta Federal Reserve’s GDPNow tracker.

Bessent’s comments come amid weakness in the labor market, which Capital Economics’ economist Jonas Goltermann pointed to as the bigger issue for U.S. equity markets than the government shutdown. “History suggests the U.S. government shutdown is unlikely to make much impact on financial markets even if it drags on for some time,” Goltermann said.

Earlier on Wednesday, Vice President JD Vance addressed reporters at the White House and warned that federal employees could face layoffs if the shutdown continues. “We don’t necessarily want to do it, but we’re going to do what we have to keep the American people’s essential services continuing to run,” he told reporters.

Meanwhile, U.S. equities traded mixed in Thursday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.12%, while the Invesco QQQ Trust (QQQ) fell 0.2%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down 0.06% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)