Advertisement|Remove ads.

SharpLink Gaming To Raise $76.5M Through Equity Offering: Retail Sees No Reason To Cheer

SharpLink Gaming Inc. (SBET) announced on Thursday that it has signed a securities purchase agreement with an institutional investor for the sale of 4.5 million common shares at $17.00 each, marking a 12% premium over the closing price on October 15.

The transaction is expected to close on or around October 17, 2025, pending customary conditions. The company expects $76.5 million in proceeds from the offering.

Alongside the initial investment, the institutional buyer secured a 90-day premium purchase contract (PPC) to acquire up to another 4.5 million shares at $17.50 per share. If fully exercised before its Jan. 15, 2026, expiration, SharpLink could raise an additional $78.8 million in gross proceeds.

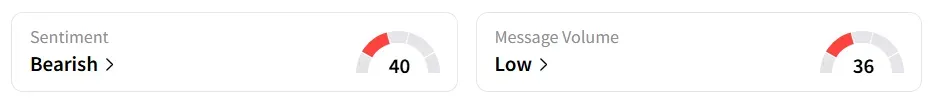

After the announcement, SharpLink Gaming stock traded over 3% higher on Thursday, after the morning bell. However, on Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

SharpLink, which has built a significant ETH portfolio, has consistently framed its Ethereum exposure as a core component of its strategy. The company’s current ETH holdings stand at 840,124. “By raising equity at a meaningful premium to both market price and NAV, we’re able to continue accumulating ETH and increasing ETH-per-share for our investors,” said Co-CEO Joseph Chalom.

Additionally, Citizens JMP has initiated coverage of SharpLink Gaming with an ‘Outperform’ rating and a price target of $50 per share, representing an upside potential of more than 200% from current trading levels, citing the company’s unique position within the Ethereum ecosystem, according to TheFly.

SharpLink Gaming stock has gained over 101% in 2025 and over 65% in the last 12 months.

Also See: AIRO-Bullet Joint Venture Targets US, NATO Markets With High-Speed UAVs

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)