Advertisement|Remove ads.

Southwest Airlines Stock Surges As Company Decides To Charge Passengers To Check Bags – Retail Sentiment Hits Year-Low

Southwest Airlines Co. (LUV) shares surged over 8% on Tuesday after the airline announced that, for the first time, it will charge passengers to check bags.

Southwest said it will continue to offer two free checked bags to its Rapid Rewards A-List Preferred Members and customers traveling on Business Select fares, and one free checked bag to A-List Members and other select customers.

The airline also said it would credit one checked bag for Rapid Rewards Credit Card members.

However, passengers not qualifying for these free bag options will be charged for their first and second checked bags. The airline did not say how much it intends to charge customers.

Changes will apply to flights booked on or after May 28, 2025.

Southwest will also introduce a new, basic fare on its lowest-priced tickets purchased on or after May 28, 2025, before offering assigned seating and extra legroom options.

CEO Bob Jordan said the airline has a tremendous opportunity to meet current and future customer needs, attract new customer segments that it doesn't compete for today, and return to the profitability levels that the firm and its shareholders expect.

"We will do all this while remaining focused on what's made us strong – our people and the authentic, friendly, and award-winning Customer Service only they can provide,” Jordan said.

Southwest’s latest decision comes months after Elliott Investment Management took a stake in the airline and pushed for changes.

According to a CNBC report, Southwest said at its investor day conference in September 2024 that it would gain between $1 billion and $1.5 billion from charging for bags but lose $1.8 billion of market share.

Southwest also said on Tuesday that it has adjusted the number of Rapid Rewards points Customers earn on qualifying flights. The airline’s passengers now earn more points on Business Select fares while earning less on Wanna Get Away and Wanna Get Away Plus fares.

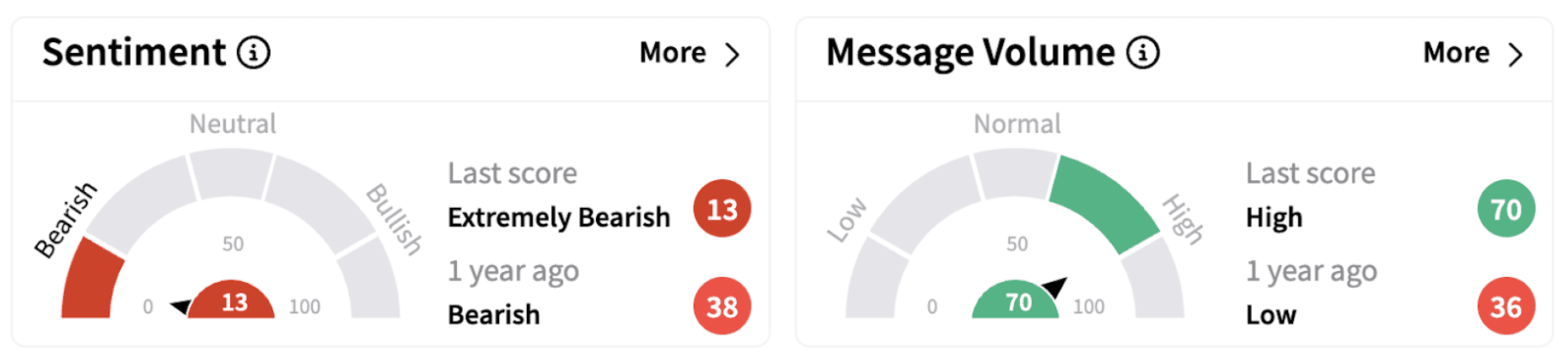

Meanwhile, retail sentiment on Stocktwits dipped into the ‘extremely bearish’ territory (13/100) from ‘bearish’ a day ago, hitting a year low. The move was accompanied by ‘high’ retail chatter.

Some Stocktwits users have expressed skepticism on the airline’s latest policy.

Southwest Airlines’ shares have lost over 8% in 2025 and are down over 9% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)