Advertisement|Remove ads.

Spotify Stock Is Down 46% From All-Time High: Q4 Earnings Will Reveal If Price Hikes, Video Push Are Paying Off

- Analysts expect Spotify’s Q4 revenue to increase 6.6% to $4.9 billion.

- Despite steady revenue growth over the past quarters and a steady stream of product initiatives, SPOT shares have underperformed, down nearly 30% this year.

- Analysts and retail investors are bullish on the company heading into the earnings results.

Investors will closely scrutinize Spotify’s fourth-quarter results before markets open on Tuesday, assessing how the music streaming giant’s recent initiatives, including subscription price hikes and its expansion into video and physical book sales. are supporting the broader business.

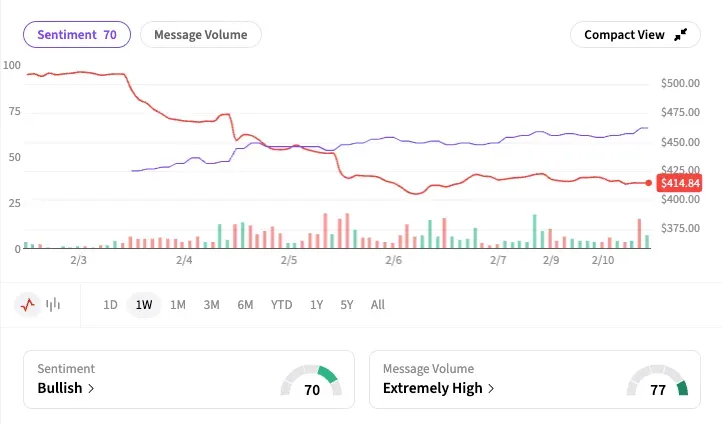

Investors hope the earnings will turn the stock around, which has languished for many months. Spotify shares are down about 46% from their peak on June 26 and down about 29% in the new year. On Stocktwits, retail sentiment for SPOT shifted to ‘bullish’ as of early Tuesday, from ‘neutral’ over the past weekend.

The report is also closely watched as the new management takes over. Spotify co-founder Daniel Ek stepped down as CEO on Jan. 1, handing the role to senior leaders and newly appointed co-CEOs Gustav Söderström and Alex Norström. Ek has taken up the role of the company’s executive chairman.

Analysts’ Take On SPOT

Wall Street maintains a bullish stance. Several firms, including Goldman Sachs, Citi, and IndeRes, raised their ratings on Spotify to “buy” in January, citing its strong pricing leverage and improving margin outlook.

Currently, 34 of 41 analysts recommend ‘Buy’ or higher on SPOT stock, six recommend ‘Hold,’ and one suggests ‘Strong Sell,’ according to Koyfin. Their average price target of $732.72 implies an over 76% upside to the stock’s last close.

They expect Spotify’s Q4 revenue to increase by 6.6% to $4.9 billion and adjusted profit to increase 62% to $3.39 per share, according to Koyfin. They expect first-quarter revenue to be $5.4 billion, a 9% increase over the same quarter last year.

Recent Initiatives

Last month, Spotify increased the subscription from $11.99 per month to $12.99 per month in the U.S., with increases in the Estonia and Latvia markets as well. U.S. prices were last increased in June 2024, just a year after the previous hike.

Meanwhile, Spotify is leaning harder on engagement and monetization initiatives. In December, the company introduced music videos for premium subscribers in the U.S. and Canada as part of its video-podcast strategy, which includes an October tie-up with Netflix.

In a unique move, Spotify is also entering physical book sales, with a partnership with Bookshop.org announced last week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Palantir Bear Michael Burry Expects Stock To Plunge Over 40% As He Flags Looming Technical Breakdown

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_9782f9c21f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AES_July_a52bf06b47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_spy_jpg_a85fe2a8bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246877055_jpg_1283ae3088.webp)