Advertisement|Remove ads.

SPY, QQQ Dip After PPI, Jobless Claims Data: Retail Turns Neutral As Focus Shifts To Powell’s Speech

The SPDR S&P 500 ETF Trust ($SPY) pulled back in late-morning trading on Thursday as the market digests the producer price inflation report for October and looks ahead to a speech by Federal Reserve Chairman Jerome Powell.

The Bureau of Labor Statistics reported, ahead of the market open, that the monthly rate of the producer price inflation (PPI) ticked up from 0.1% in September to 0.2% in October. The increase was in line with expectations.

The core producer price index (CPI) rose 0.3% month-over-month, quickening from a 0.1% rate in September but matching economists’ expectations.

The annual rates of both producer price and core producer price inflation accelerated more than expected from 1.9% and 2.9%, respectively, to 2.4% and 3.1%. Economists, on average, anticipated 2.3% and 3% year-over-year increases.

Commenting on the data, Jeffrey Roach, chief economist at LPL Financial said the biggest contributor to the rise in final demand producers was portfolio management, which is immune to tariffs.

Prices for those in the wholesaling and retailing industries fell year-over-year, he said.

Roach cautioned regarding slightly more volatility in producer prices, as businesses manage supply chains amid the risk of tariffs.

The consumer price inflation report released on Wednesday showed in-line readings across the board.

A separate Labor Department report showed the number of individuals claiming unemployment benefits came in at 217,000 for the week ended Nov. 9, the lowest since May. This compared to the previous reporting week’s 221,000 and the consensus estimate of 223,000.

The benchmark 10-year Treasury note yield fell 2.5 basis points to 4.424% following the data. The odds of a 25-basis-point Fed funds rate hike dropped slightly from 82.5% on Wednesday to 79.1%, according to CME FedWatch tool.

The focus now shifts to Powell’s speech scheduled for 3 p.m. ET.

As of 10:56 a.m. ET, the SPY was down 0.11% to $595.53 and the Invesco QQQ Trust ($QQQ) slipped 0.20% to $511.22.

The drop has come despite AI-bellwether NVIDIA Corp. ($NVDA) rising strongly.

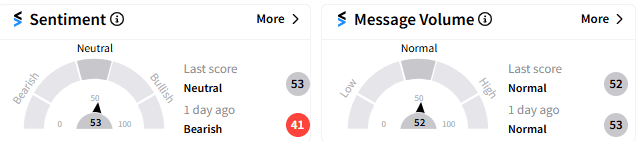

Retail sentiment toward SPY is currently ‘neutral’ (52/100), accompanied by ‘normal’ message volume.

Read Next: JD.com Stock Listless Despite Q3 Profit Beat: Retail Is Doubling Down

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)