Advertisement|Remove ads.

Retail sentiment for Starbucks has entered extremely bullish territory: What's changed?

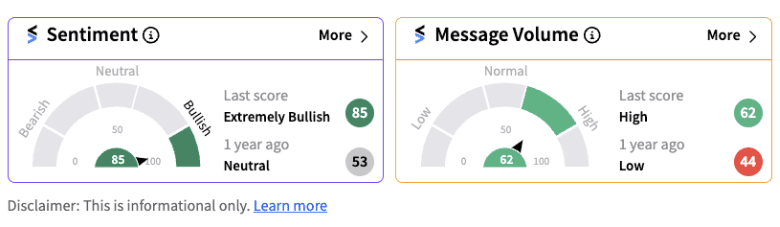

Retail sentiment shifted into extremely bullish territory (85/100) for Starbucks Corp shares after the firm entered into a strategic collaboration with Mercedes-Benz High-Power Charging to electrify over 100 Starbucks stores nationwide. The Stocktwits sentiment meter hit a one-year high, supported by significant message volumes.

The firms said in a release that their vision for the program's first phase is to co-locate 400 kW electric vehicle (EV) chargers at Starbucks stores along Interstate 5, a critical west coast travel corridor spanning Canada to Mexico.

The coffee chain is also implementing its Siren Craft System, designed to elevate the partner experience and reduce customer wait times. The system includes new routines for popular beverages – including streamlined steps for creating orders, new positions, and digital tools to manage expected demand growth proactively.

During the second quarter, Starbucks reported revenue of $8.56 billion, compared to a Street estimate of $9.13 billion. Adjusted earnings per share came in at 68 cents, topping the consensus estimate of 79 cents.

As the firm dealt with various issues like disappointing earnings, unionization, inflation, and boycotts, it joined a growing number of fast food chains last month in offering a $5 meal.

For the current fiscal year, the firm has projected revenue growth in the low single digits compared to its earlier forecast of 7-10%. The firm revised its estimates for global and US same-store sales growth to the low single digits to flat compared to its previous forecast of 4-6%.

Starbucks shares have significantly underperformed this year, with a YTD loss of over 19%. Deutsche Bank has lowered its price target on the stock to $85 from $89 with a ‘Hold’ rating.

Still, some Stocktwits users, like ‘fdboy1616,’ have expressed optimism that the stock could soon shoot over the $85 mark due to these new tailwinds. With the stock currently trading near $75, that would represent roughly 13% in potential upside.

Photo Courtesy: TR from Unsplash

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oscar_health_jpg_89aa74c6fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2164981884_jpg_940b22ebde.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)