Advertisement|Remove ads.

Stellantis’ US Sales Drop Results In Downgrade At Wolfe, Firm Flags ‘Meaningful Risk’ To 2025, 2026 Earnings

Brokerage Wolfe Research on Wednesday downgraded automaker Stellantis NV (STLA) to ‘Underperform’ from ‘Peer Perform’ with a €6 price target.

The firm sees “meaningful risk” to the Chrysler parent’s 2025 and 2026 earnings, driven primarily by North America, as per TheFly. Wolfe’s earnings estimates are about 40% below consensus in 2025 and 45% below in 2026.

The firm models about a €1 billion (approx. $1.18 billion) loss in North America this year, versus the consensus call for a roughly €1.6 billion profit, and added that "even this may be optimistic."

Stellantis reported a sales drop of 10% in the U.S. in the second quarter on Tuesday despite a rise in sales for select brands including Ram, Jeep, and Fiat.

Drop in sales of Alfa Romeo, Chrysler, and Dodge vehicles, however, offset the growth of the other brands.

In contrast, rivals General Motors (GM) and Ford (F) on Tuesday reported a growth in sales in the U.S. While Ford announced a 14% growth in Q2 sales, GM said that its sales in the country rose by 7% in the period.

Stellantis has been struggling in North America. For full-year 2024, Stellantis reported a 25% drop in shipments in North America, a 27% reduction in net revenue, and an 80% lower adjusted operating income in the region.

Stellantis’ new CEO, Antonio Filosa, took charge of the company late last month and said that he will retain his role as head of North America and American brands.

Stellantis had been looking for a CEO since December following the departure of its previous chief executive, Carlos Tavares.

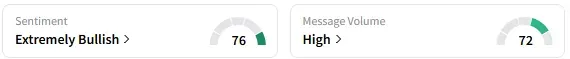

On Stocktwits, retail sentiment around Stellantis rose from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘high’ levels.

STLA stock is down by about 22% this year and by 48% over the past 12 months.

Read Next: Baidu Reportedly Overhauling Flagship Search Engine Amid Slump In Ad Revenue

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)