Advertisement|Remove ads.

Will 2024 Presidential Election Fuel Typical November Gain For Market? Here’s What Retail Says

The stock market has extended its rally in 2024 and has been higher in eight of the 10 months so far, with the 2024 presidential election around the corner.

The major averages posted monthly losses in October, dragged by mixed big tech earnings and a mixed batch of economic data. A market strategist shrugged off the October setback as something that is typical in election years.

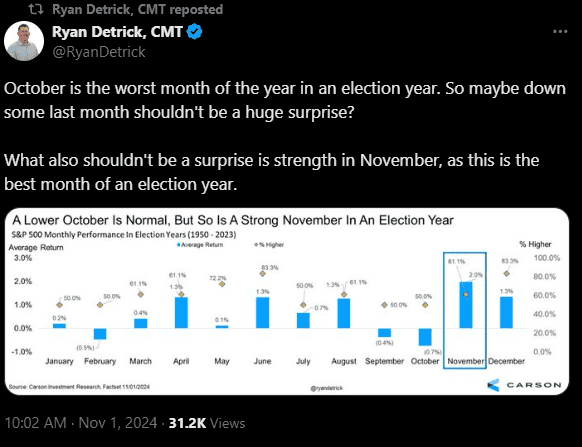

Carson Group’s Chief Market Strategist Ryan Detrick shared a graphic on social media platform X that showed an average negative return of 0.7% for the S&P 500 in October during election years.

With November, things take a turn for the better. The average gains for November and December are at 2% and 1.3%, respectively, with the former's performance best among all months in an election year.

Notwithstanding the losses for the month, the indices are up solidly for the year. For the year-to-date period, the Dow Jones Industrial Average, the S&P 500, and Nasdaq Composite indices are up 11.58%, 20.10%, and 21.51%, respectively.

Detrick said in a separate post that the November-January period is the best three months for stocks in any year.

The 2024 presidential election will go down in history as one of the most closely fought ones. Polling analytics firm FiveThirtyEight’s data that compiles results from several nationwide polls showed Vice President Harris barely ahead (47.9%) of her rival Donald Trump (0.9%). On betting platform Polymarket, Trump is seen ahead of Harris by a 56%-44% margin.

Until the dust settles after Tuesday’s election, the market could be in a state of flux.

Economist David Rosenberg sees the 2024 election as the “mother of all contested elections replete with recounts and legal challenges.” In a post on X, he said, “It will be Gore vs Bush in November 2000 on steroids. Remember that period of political uncertainty lasted a full month and went all the way to the Supreme Court,”

He recommended going long on gold, bonds, and the VIX and shorting S&P 500 Index and the U.S. dollar.

On Stocktwits, a user flagged $565 as a key support area for the SPDR S&P 500 ETF Trust ($SPY), an exchange-traded fund that tracks the S&P 500 Index, and $575 as the resistance area.

Another user factored in a Harris victory and looked around for plays that do well under a potential Democratic administration.

Read Next: Palantir Q3 Report On Tap Monday As Stock Trades With Over 140% Gain For Year: Retail Mostly Upbeat

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)