Advertisement|Remove ads.

Stocks To Watch: Angel One, Varun Beverages Approach Key Levels, Says SEBI RA Krishna Pathak

Two stocks are on top of SEBI-registered analyst Krishna Pathak’s watchlist: Angel One and Varun Beverages, as the stocks hover above critical levels. He recommended these stocks during an Ask Me Anything (AMA) session held on Stocktwits on Tuesday.

Let’s take a look at the rationale behind his bullish calls:

Angel One

Angel One is currently trading just below its 9-week exponential moving average (EMA) at ₹2,840, which is also acting as a near-term resistance, Pathak said.

The stock has been consolidating in a range, with resistance around ₹2,720 and strong support near ₹2,500. A round bottom pattern has formed, and the current price action suggests a potential retest of support to validate this setup, he added.

Angel One stock closed 3.5% lower at ₹2,691.80 on Tuesday, declining 8.3% year-to-date (YTD)

Pathak recommended taking up positions at the ₹2,600 - ₹2,620 accumulation zone, where previous buying interest had been observed.

A breakout above ₹2,720 could open the path for further upside, with price targets at ₹2,960, ₹3,080, and potentially ₹3,277 in the short term, a 20% premium considering the upper limit of the target.

However, if the price breaches below ₹2,500, it could signal weakness and trigger a deeper correction, he added.

Varun Beverages

Varun Beverages is trading slightly above its 9-week EMA of ₹450, suggesting early signs of stability, the analyst said. The stock has been consolidating within a broader downtrend, with strong support near ₹310.

Varun Beverages stock had shed over 28% YTD.

The ₹440 - ₹450 zone has previously seen buying interest, making it a potential add-on accumulation range. A breakout above ₹470 could trigger a sharp move toward upside targets of ₹590, ₹645, and eventually ₹715, he added. The upper end of the target represents a 52% premium.

However, Pathak advises caution if the stock breaks below ₹310, as it could lead to a deeper correction. Overall, technical analysis suggests a favorable short-term risk-reward setup.

The shares closed 1.3% lower at ₹458.05.

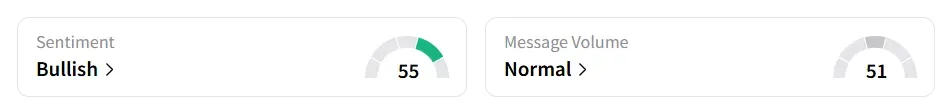

On Stocktwits, retail sentiment turned ‘bullish’ from ‘neutral’ a week ago.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)