Advertisement|Remove ads.

Alphabet’s Post-Earnings Dip Buying Opportunity? Nearly 70% Of Stocktwits Users Think So - ‘Stock You Own, But Don’t Trade’

Alphabet, Inc. (GOOG) (GOOGL) shares came under pressure on Wednesday as traders reacted negatively to a slight topline miss and softer-than-expected Cloud revenue. Retail users on the Stocktwits platform were not too worried about the pullback and instead smelled a buying opportunity.

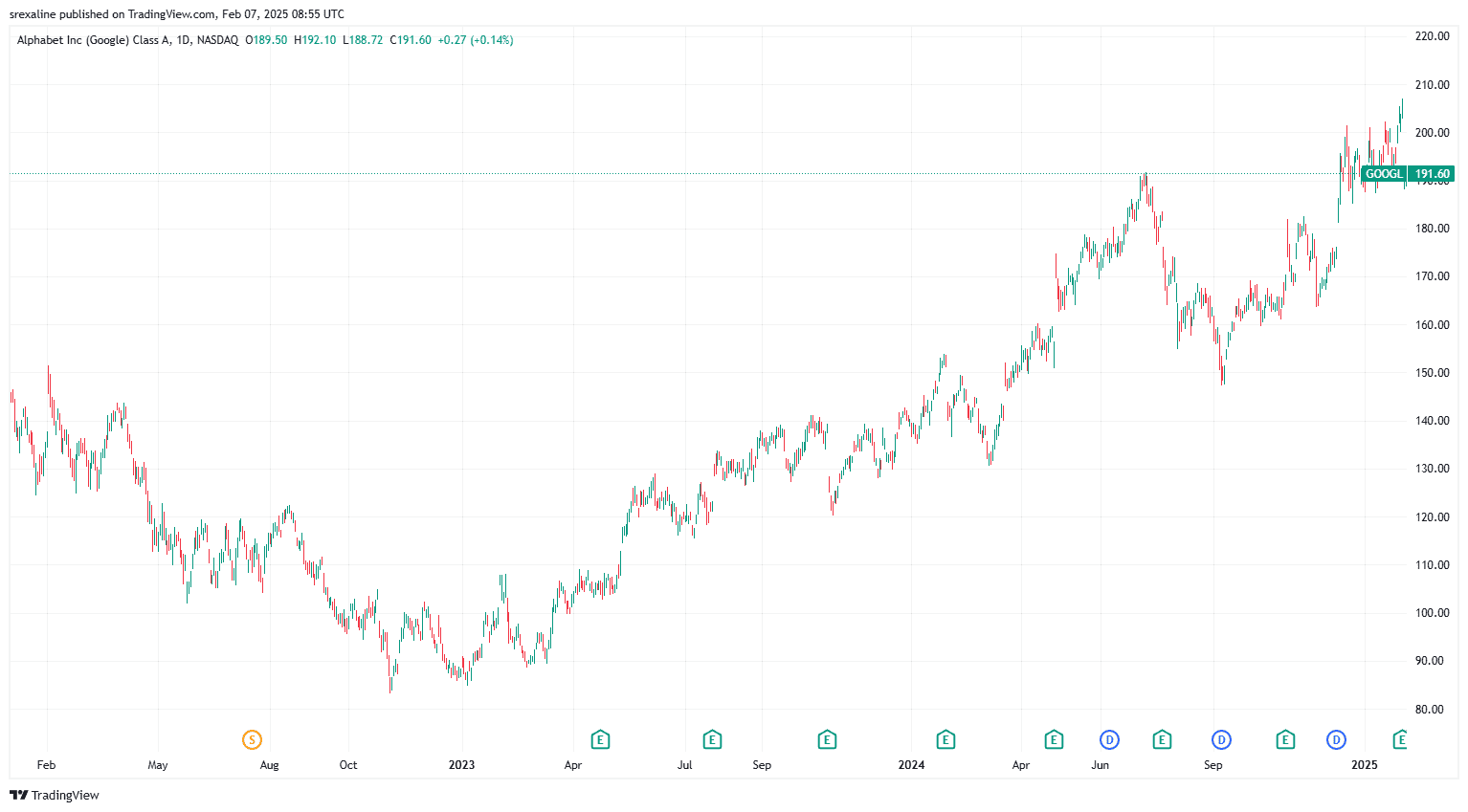

A late-year surge in Alphabet stock came about in 2024 amid a general rise in risk appetite following Donald Trump’s election and the company's product innovation and enhancements. The stock ended the year with a 31% gain.

The momentum carried over into the new year as it tacked on another 9% ahead of last Tuesday’s earnings report, ending at a fresh high of $206.38. In the same session, it also clocked an intraday high of $207.05.

Negative reaction to the fourth-quarter earnings report dragged the stock below the $200 level, and it settled Wednesday’s session down 7.3% at $191.33. The stock stalled the losses and yet ended only modestly higher on Thursday.

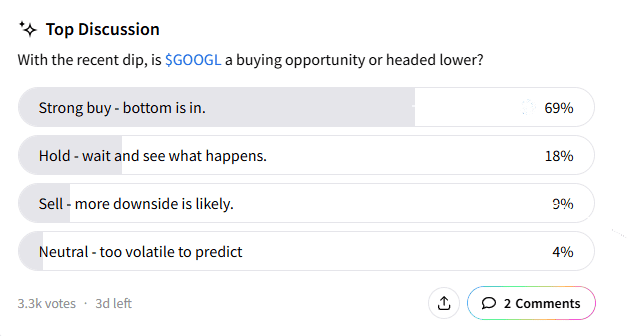

An ongoing Stocktwits poll that probed users about Alphabet stock’s trajectory showed that 69% of the 3,300 respondents who have participated so far think the stock is a “strong buy’ and the bottom is already in.

Eighteen percent opted to “hold” the stock, waiting to see how things pan out, and 4% said it is “too volatile to predict,” while 9% recommended selling, anticipating more downside pressure.

A user who commented on the poll said Alphabet is a “stock you own, but don’t trade.” They made their case by stating that holding the stock when it dropped to $166 in November amid fears of a potential breakup of the company has left them with an 18% profit in a three-month period.

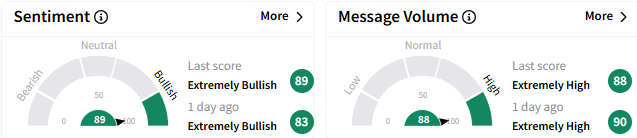

Retail sentiment toward the stock remained “extremely bullish” (89/100) and the message volume stayed “extremely high.”

A retail watcher said the stock will be high on their radar on Friday, with a likely support around the $189.5 level.

Another user saw the current valuation as very attractive given their assessment of the fair valuation at $258.

The stock could have about a 13% upside from current levels, going by the TipRanks-compiled consensus price target of $216.39.

Morgan Stanley analyst Brain Nowak, who took down the price target for the stock to $210 from $215 following the fourth-quarter print, said the company is investing to fuel its generative artificial intelligence (GenAI) portfolio but the incremental return on invested capital matters.

The analyst sees the need for the company to ship new products to provide incremental engagement, revenue, and free cash flow. Otherwise, valuation multiples will likely be range-bound around the 16 times to 20 times levels, he added.

In premarket trading, the stock edged down 0.30% to $191.03, although the trading direction will largely hinge on the market reaction to the January non-farm payrolls report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Qualys Q4 Beats Estimates But Guidance Disappoints: Retail Sentiment Nosedives As Stock Plunges

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238161001_jpg_d763653491.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)