Advertisement|Remove ads.

Strategy Stock Drops Despite $2B Bitcoin Purchase Amid Retail Pessimism, Hits 4-Month Low

Strategy (MSTR) shares dropped more than 5% in morning trading on Monday, hitting their lowest level in nearly four months, despite the company disclosing a $2 billion Bitcoin (BTC) purchase.

The latest acquisition of 20,356 BTC brings the firm’s total holdings to just under 500,000 BTC, reinforcing its position as the largest corporate holder of the cryptocurrency.

The purchase marks Strategy’s return to Bitcoin buying after a brief pause following its last disclosed acquisition on Feb. 10.

However, the move failed to lift the company’s stock price or Bitcoin’s value.

Strategy’s shares have fallen nearly 24% over the past month, while Bitcoin has declined just 9.4%.

On Monday, Bitcoin was down 1.1%, trading below $95,000.

Strategy’s total Bitcoin holdings now stand at 499,096 BTC, valued at approximately $47.4 billion.

According to data from SaylorTracker, the firm holds an unrealized profit of over $14.8 billion on these holdings.

However, the company – formerly known as MicroStrategy – faces a potential tax liability under the Inflation Reduction Act’s Corporate Alternative Minimum Tax (CAMT), which could impose a 15% tax on unrealized gains starting in 2026.

This means Strategy may be taxed on its Bitcoin holdings even if it does not sell them, a risk the firm acknowledged by the company in a recent regulatory filing.

The purchase follows its latest $2 billion senior convertible note offering, announced on Feb. 24 as part of its broader “21/21 Plan.”

The company aims to raise $42 billion over three years through equity and fixed-income securities to fund continued Bitcoin purchases. So far, it has secured $20 billion toward that goal.

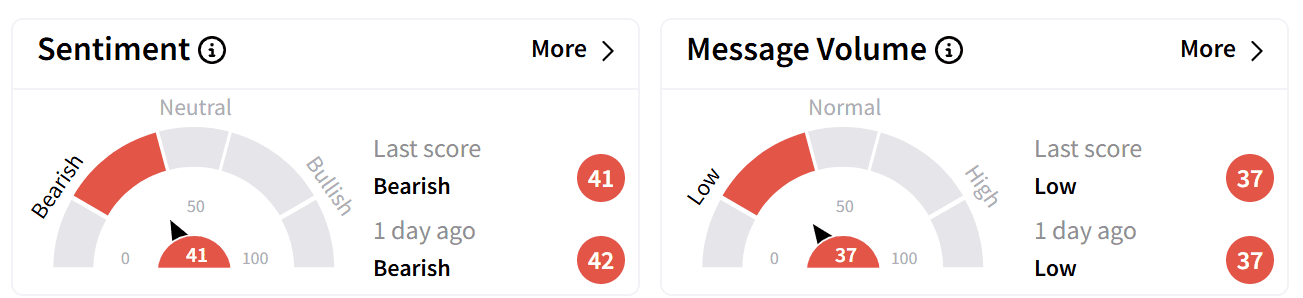

On Stocktwits, retail sentiment around Strategy’s stock remained ‘bearish’, with traders noting that MSTR shares had slipped to their lowest levels in nearly four months.

From Jan. 1 to Feb. 23, MicroStrategy reported a Bitcoin yield of 6.9%, adding 30,702 BTC to its holdings, with a gain of approximately $2.94 billion based on Bitcoin’s market price as of Feb. 23, according to its latest regulatory filing.

Despite the recent downturn, Strategy’s stock remains up 312% over the past year, far outpacing Bitcoin’s 85% gain in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)