Advertisement|Remove ads.

Bitcoin Outflows Dominate $508M Crypto ETP Sell-Off, But XRP Bucks the Trend – Retail Sentiment Remains Bearish

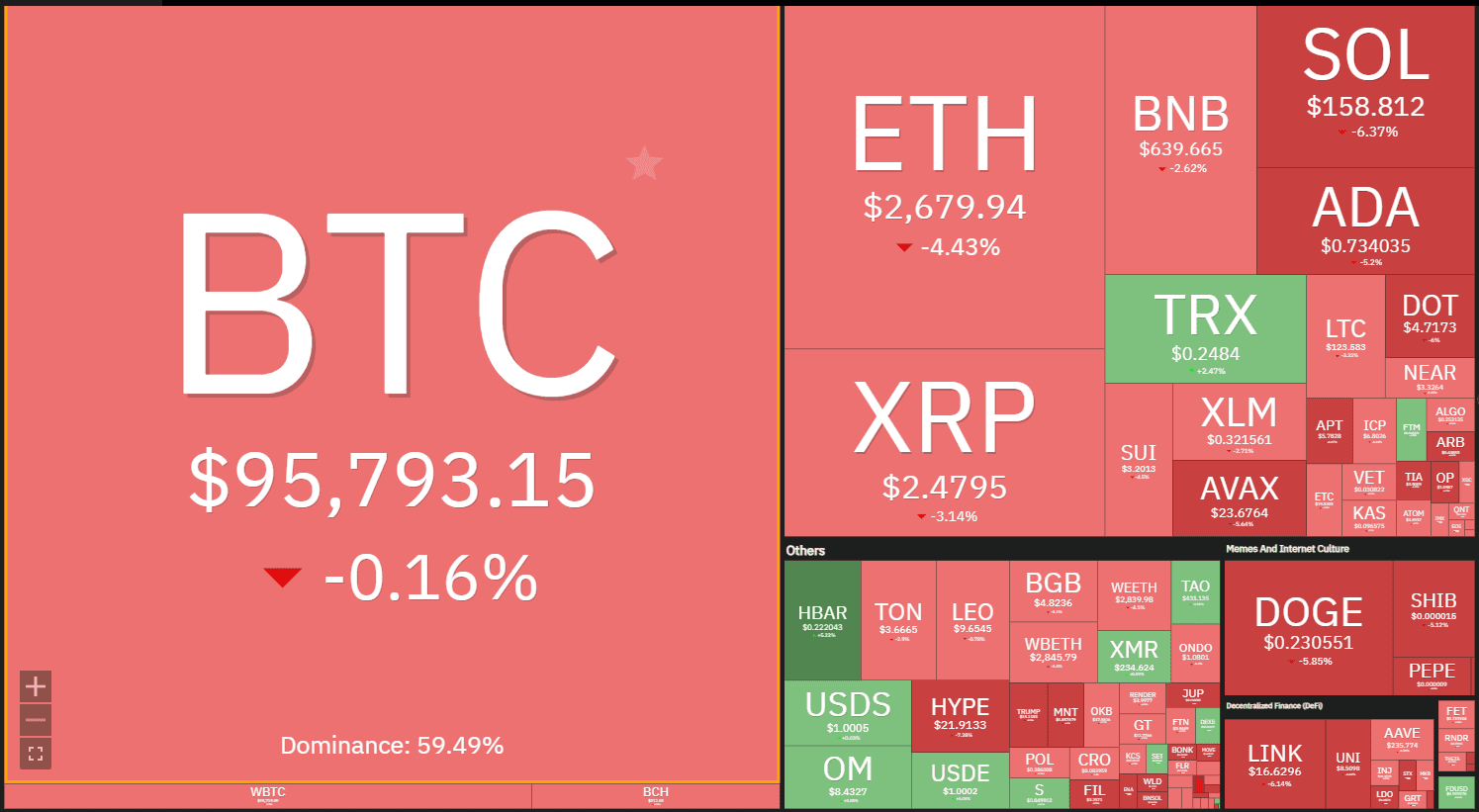

Cryptocurrencies declined in pre-market U.S. trading hours on Monday, with total market capitalization falling 3% to approximately $3.25 trillion.

This was led by mounting investor caution and continued outflows from exchange-traded products (ETPs), compounded by the recent Bybit security breach.

According to digital asset investment firm CoinShares, crypto ETPs saw $508 million in outflows over the past trading week, extending the previous week's $415 million figure.

The net outflows over the last two weeks now stand at $924 million, marking a reversal after 18 consecutive weeks of inflows totaling $29 billion.

“We believe investors are exercising caution following the U.S. Presidential inauguration and the consequent uncertainty around trade tariffs, inflation, and monetary policy,” said CoinShares research head James Butterfill in the report.

Bitcoin was the primary focus, seeing $571 million in outflows, with some investors choosing to add to short positions.

Bitcoin ETPs accounted for the bulk of outflows, with $571 million exiting the market. Some investors also increased their short positions, signaling skepticism about Bitcoin’s near-term price direction.

In contrast, altcoins saw significant inflows. XRP led the pack, attracting $38.3 million, bringing its total inflows since mid-November 2025 to $819 million.

According to CoinShares' weekly report, investor optimism surrounding XRP appears linked to expectations that the U.S. Securities and Exchange Commission (SEC) may drop its lawsuit against Ripple.

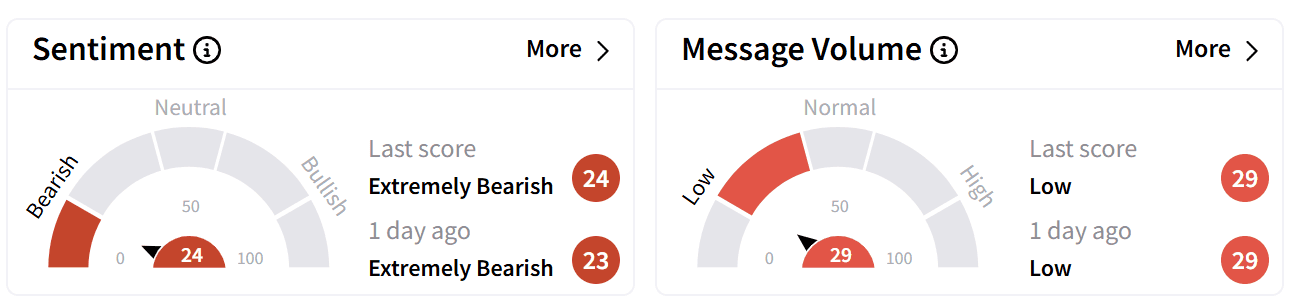

Despite Ethereum’s inflows, retail sentiment around ETH on Stocktwits remained in the ‘extremely bearish’ zone.

Users on the platform expressed frustration over price resistance levels and market weakness.

XRP, which has struggled to break above the $2.60 resistance level, fell 3% on the day, mirroring the broader market downturn.

Other altcoins also saw positive flows, with Solana (SOL), Ethereum (ETH), and Sui (SUI) recording inflows of $8.9 million, $3.7 million, and $1.47 million, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Ethereum Under Pressure – Bybit Replenishes $1.23B ETH Reserves, Stolen Funds May Head to Mixers

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Mojtaba_Khamenei_jpg_d2c198ccb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Biotech_lab_research_4e46efbd94.jpg)