Advertisement|Remove ads.

Strategy Stock Sinks On $2B Debt Plan To Buy More Bitcoin: Retail Frustrations Linger

Shares of Strategy Inc. (MSTR), formerly MicroStrategy, fell over 1% in Tuesday’s trade as the company announced a private offering of $2 billion convertible notes, due in 2030, to further fund its Bitcoin (BTC) purchases.

The convertible notes carry a 0% interest rate, and Strategy says it will use the funds for general corporate purposes, including buying Bitcoin and meeting working capital requirements.

The announcement helped Bitcoin trim some of its losses and climb back above the $95,000 level, but despite this, the cryptocurrency was down 0.90% over the past 24 hours.

This is a part of Strategy’s plan to raise $42 billion in capital to fund its Bitcoin purchases – the company announced that it would raise $21 billion through at-the-market (ATM) equity offering, and $21 billion through fixed-income securities.

Strategy currently holds 478,740 BTC, purchased at an average cost of $65,033, totaling $31.13 billion. At the current BTC price of $95,282, Strategy’s holdings are worth $45.61 billion, implying an unrealized gain of 46.5%.

Strategy also disclosed that it had laid off over 20% of its workforce over the last year—it had 1,534 employees at the end of 2024, 400 fewer than a year ago.

According to the company's latest SEC filing, research and development, sales and marketing, and consulting were the departments worst hit by layoffs.

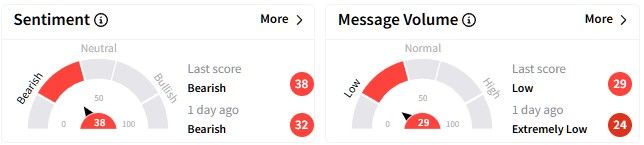

Retail sentiment on Stocktwits about the Strategy stock remained ‘bearish’ (38/100), while message volume edged up as users discussed the company’s fundraising and layoffs.

One user said buying the MSTR stock on Tuesday was a “mistake,” as they explained their bearish outlook.

In contrast, one user thinks the Strategy stock was more resilient than Bitcoin.

Strategy’s shares have decreased recently, falling more than 14% over the past month.

Bitcoin prices, too, have been falling, declining nearly 9% during this period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)