Advertisement|Remove ads.

Ethereum, Cardano See Retail Chatter Surge Over The Past Week, But Trump’s Mixed Messages Dampen Sentiment

Retail chatter around cryptocurrencies spiked last week as traders grappled with conflicting signals from President Donald Trump’s comments on digital assets.

Confusion over his stance led to a surge in discussions on Stocktwits, with Bitcoin (BTC) chatter rising 58% above its yearly average.

Cardano (ADA) and Ethereum (ETH) saw even steeper increases, up 376% and 182%, respectively, according to platform data.

A rise in retail chatter, however, does not always translate into a stronger sentiment.

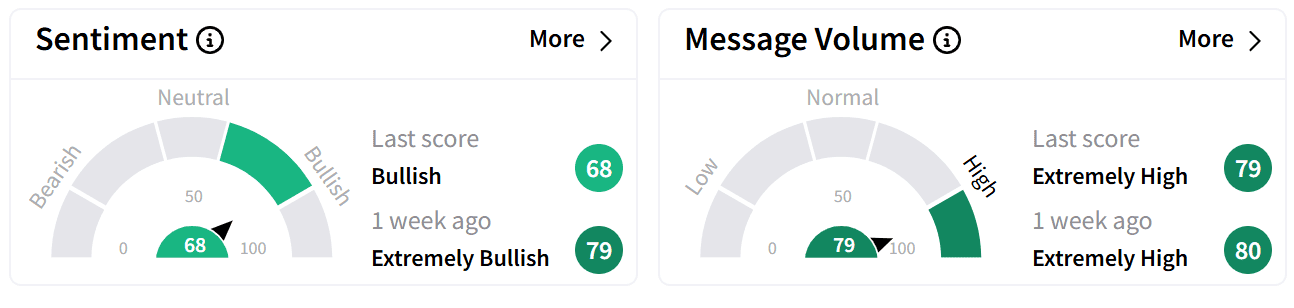

Retail sentiment around Cardano’s token dipped to ‘bullish’ from ‘extremely bullish’ a week ago, accompanied by ‘extremely high’ levels of chatter.

One user cited Cardano’s security features, which give it an edge over its peers, as the reason for continuing to be bullish on the token.

ADA’s price was down over 5% in U.S. market hours, with gains of just 0.7% over the past year.

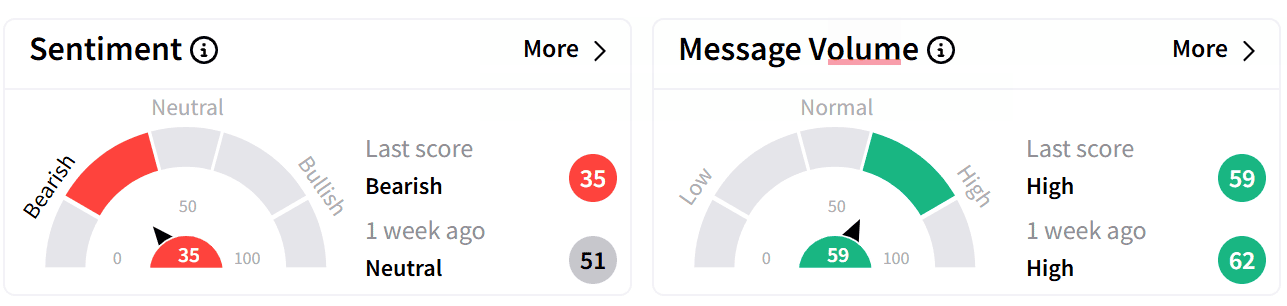

Meanwhile, retail sentiment around Ethereum’s native token, Ether, saw a sharper shift, flipping to ‘bearish’ from ‘neutral’ a week ago.

One user anticipates that the token will dip to below $2,000 by the end of the day.

ETH fell to an intraday low of $2,001 on Monday, marking its lowest since November 2023.

The cryptocurrency was down over 1% in U.S. market hours, adding to its 46% decline over the past year.

Trump initially stated that his January executive order on digital assets would lead to a government stockpile, including Bitcoin, Ether, Ripple’s XRP (XRP), Solana (SOL), and Cardano. These specific names had not been mentioned previously.

The announcement briefly lifted cryptocurrency prices, but optimism quickly faded when Trump clarified that the proposed Bitcoin Strategic Reserve would consist solely of previously seized BTC – and potentially other confiscated assets in the future.

The government would not be purchasing additional cryptocurrencies, undercutting expectations of broader market support.

According to AI and Crypto Czar David Sacks, Trump mentioned Cardano, Solana, and XRP in the reserve context purely because of their market capitalization – not because the administration intends to acquire them.

The White House Crypto Summit further dampened sentiment by failing to provide updates on the Bitcoin Strategic Reserve or whether other digital assets would be included.

The lack of policy direction and ongoing uncertainty over tariffs weighed heavily on the market. Bitcoin fell over 10% over the weekend, dragging the broader cryptocurrency sector down.

Stocktwits data shows retail chatter around XRP was 69% above its yearly average last week, while Solana saw a surge of around 28%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)