Advertisement|Remove ads.

StubHub's Retail Investors Unfazed After Stock Drops On NYSE Debut

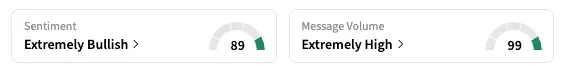

StubHub gained significant buzz on Stocktwits on Wednesday, despite the ticketing company's stock ending lower on its market debut.

Retail watcher count on the platform more than doubled to nearly 1,400, while sentiment climbed higher in the 'extremely bullish' zone.

StubHub shares gained as much as 18% in the early hours before losing steam. The stock closed 6.4% lower on Wednesday, compared to its IPO price of $23.5, and fell another 0.4% in the after-hours session.

Notably, the ticketing platform had raised its IPO price range just last week. While this signals robust investor demand, it also risks some seeing the stock as overvalued and adds pressure for a strong debut performance.

"$STUB these ipo pumps are getting shorter and shorter. Careful what you’re diving into," a Stocktwits user remarked.

Another retail user said they are buying the dip, noting the high demand for entertainment. "$STUB is my proxy into it. People need entertainment, always."

Last week, half a dozen companies led by fintech giant Klarna raised more than $4 billion combined, marking the busiest week for the U.S. IPO market since 2021, according to Reuters.

StubHub offers a marketplace for people to buy and sell tickets for live events, including concerts, sports games, theater, and festivals. It was founded in 2000 and was owned by eBay in between before founder Eric Baker bought it back.

The company raised about $800 million in the IPO. Its latest market cap is $8.1 billion.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)