Advertisement|Remove ads.

Sun Pharma Shares: SEBI RA Spots Buy-On-Dip Opportunity As Stock Holds ₹1,600 Support

Shares of Sun Pharmaceutical Industries are showing signs of strength after bouncing back from a recent dip.

SEBI-registered analyst Deepak Pal said that the stock found support at ₹1,600 after slipping to ₹1,636.10 on June 19.

It climbed to ₹1,704.30 by June 30 before easing slightly, but has stayed above its 14-day exponential moving average (EMA). On Wednesday, Sun Pharma opened and bottomed at ₹1,656.00 before inching up to around ₹1,680.

Pal said a close above ₹1,700 could signal further upside, potentially toward ₹1,750–1,760, with the 55-day EMA offering support.

He suggested a buy-on-dip strategy with a stop-loss at ₹1,600 for those looking at near-term opportunities.

On the fundamental side, Pal highlighted Sun Pharma’s strong FY24 performance, with revenue rising 12% year-on-year to ₹49,505 crore and net profit at ₹9,602 crore. Core profit margins remained steady at around 27%.

With steady free cash flow, low debt levels, and 6–7% of revenue going toward R&D, Pal said the company is well-positioned for long-term growth.

He also noted Sun Pharma’s growing presence in global markets and its focus on complex generics and specialties, such as dermatology and oncology.

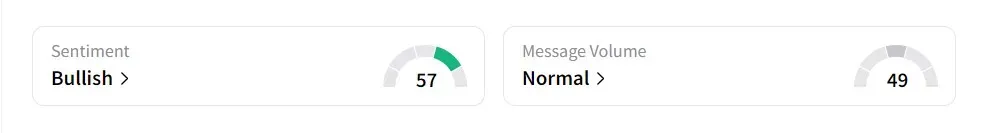

On Stocktwits, retail sentiment was ‘bullish’ amid ‘normal’ message volume.

The stock has declined 11.3% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)