Advertisement|Remove ads.

Surf Air Mobility Stock Rises After-Hours On Upbeat Q4 Revenue, Retail’s Split

Surf Air Mobility (SRFM) stock gained 3.1% in after-hours trade on Tuesday after the company’s fourth-quarter revenue topped Wall Street’s estimates.

The company, which operates charter and regional flights, posted fourth-quarter revenue of $28.05 million, while analysts expected it to post $26.90 million, according to Koyfin data.

The company attributed the revenue rise to a 39% spike in on-demand service revenue, which was driven by higher sales and flight completions.

However, its revenue was impacted by a 4% fall in scheduled service revenue due to the elimination of unprofitable routes.

The Surf Air parent posted a net income of $1.3 million for the three months ended Dec. 31, compared with a net loss of $111 million a year earlier.

The year-ago quarter included a goodwill impairment charge of $60 million.

“During 2024, we successfully captured synergies from our merger with Southern Airways, drove efficiencies across our organization, began exiting unprofitable routes, and reduced our general and administrative costs,” CEO Deanna White said.

The company forecast first-quarter revenue between $21 million and $24 million. It said the projection reflects the exit from unprofitable scheduled routes and a focus on the profitability of the on-demand business.

Wall Street currently expects it to post $31 million in revenue.

Surf Air Mobility also reaffirmed its expectations that 2025 revenue will exceed $100 million and its Airline operations will achieve profitability.

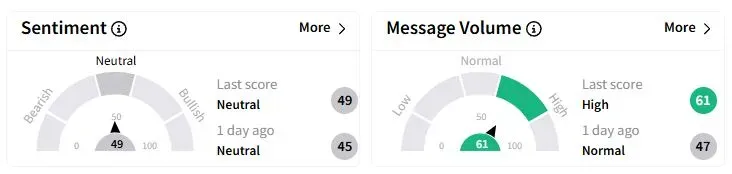

Retail sentiment on Stocktwits moved higher into the ‘neutral’ (49/100) territory, while retail chatter rose to ‘high.’

One retail trader said the company has a clear plan for profitability in 2025.

While another user said they would buy the stock if it fell to $2.50.

Surf Air Mobility shares have fallen 28.8% year-to-date (YTD).

Also See: Spire Global Stock Jumps After Launching Weather Models Built On Nvidia’s Tech, Retail Stays Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)