Advertisement|Remove ads.

Synopsys To Cut 10% Of Workforce After Ansys Acquisition

- Synopsys will cut 10% of its workforce as of the end of fiscal 2025.

- The restructuring initiative is expected to result in estimated pre-tax charges of between $300 million and $350 million.

- The $35 billion Ansys acquisition was completed in July.

Synopsys Inc. (SNPS) announced on Wednesday that its Board of Directors has approved a major restructuring plan, which will result in the reduction of roughly 10% of its global workforce as of the end of fiscal 2025.

The move is aimed at streamlining operations and focusing resources on strategic growth areas following its recent acquisition of ANSYS Inc.

Financial Implications

The chip designer stated that the restructuring initiative will result in estimated pre-tax charges between $300 million and $350 million. These costs will include severance payments, site closures, and other one-time expenses associated with the company’s global site optimization strategy.

Synopsys expects to complete most of the layoffs during fiscal 2026 and finalize the broader restructuring plan by the end of fiscal 2027, subject to local laws and processes.

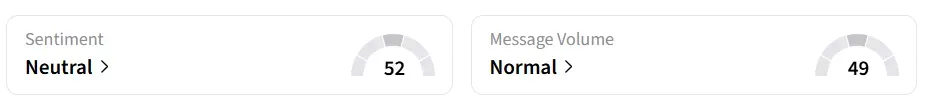

Synopsys’ stock inched 0.6% higher on Wednesday morning. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘normal’ message volume levels.

Ansys Acquisition

The $35 billion Ansys acquisition was announced on Jan. 16, 2024, and was completed on July 17, 2025, as China's antitrust authority delayed the approval amid political and trade friction with the U.S.

Chinese authorities had greenlit the acquisition under a set of obligations. The merged company is expected to provide Chinese customers with continued, unbiased access to electronic design automation tools.

Synopsys provides engineering tools and services that help companies design and build advanced, AI-driven products. The company offers solutions for chip design, intellectual property (IP), and simulation.

The firm will report its fourth-quarter earnings on December 10. Analysts anticipate a revenue of $2.24 billion and earnings per share (EPS) of $2.78, according to Fiscal AI data.

SNPS stock has lost over 17% year-to-date and 28% in the last 12 months.

Also See: Morgan Stanley Says AMD’s Market Share Gain Is Key To Its AI Strategy

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)