Advertisement|Remove ads.

Take-Two Stock Climbs To 4-Year High After Video-Game Software Maker Reports Mixed Q3, Confirms GTA VI Fall Launch: Retail Cheers

Take-Two Interactive Software, Inc. (TTWO) shares climbed in Thursday’s after-hours session following the video game software maker’s mixed fiscal year 2025 third-quarter results.

New York-based Take-Two reported a third-quarter GAAP loss per share of $0.71, which widened from the year-ago loss of $0.54, according to Yahoo Finance. However, it was narrower than the $0.90 per share loss estimated by analysts.

Net revenue fell marginally to $1.36 billion from $1.37 billion last year, trailing the consensus estimate of $1.39 billion. The company noted that recurrent revenue increased by 5%, accounting for 80%.

Total net bookings increased 3% to $1.37 billion from $1.34 billion, with net bookings from recurrent consumer spending rising 9% and accounting for 79% of the total.

CEO Strauss Zelnick said, “We achieved solid results during the holiday season.” He noted that net bookings benefited from a significant outperformance in NBA 2K, which helped offset moderation in several mobile franchises.

He added that operating results exceeded expectations, thanks to the upside from NBA 2K and a shift in expense timing that benefited the quarter.

The company maintained its net revenue guidance for fiscal year 2025 at $5.57 billion to $5.67 billion and narrowed its net loss per share guidance to $4.17 to $4.50 from $4.43 to $4.80. This surrounded the consensus estimate of $5.62 billion in revenue and $4.39 in loss per share.

Take-Two reiterated its full-year net bookings guidance at $5.55 billion to $5,65 billion.

For the fourth quarter, the company expects net revenue in the range of $1.519 billion to $1.619 billion, and the bottom line in the range of a loss of $0.20 per share to earnings of $0.13 per share.

Analysts, on average, expect revenue of $1.54 billion and a profit of $0.12 per share.

Net bookings for the quarter are expected at $1.484 billion to $1.584 billion.

The company said the calendar year 2025 is shaping up to be on the strongest ever as it plans to launch Sid Meier’s Civilization VII on Feb. 11, Mafia: The Old Country in the Summer, Grand Theft Auto (GTA) VI in the Fall, and Borderlands 4.

Zelnick said, ‘As we continue to deliver hits, we remain highly confident that we will achieve sequential increases in, and record levels of, Net Bookings in Fiscal 2026 and 2027.”

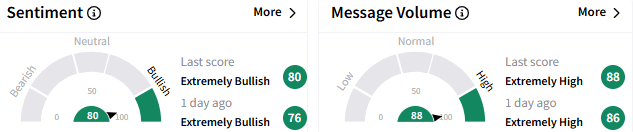

On Stocktwits, sentiment toward Take-Two stock remained ‘extremely bullish’ (80/100), with the degree of bullishness improving from a day ago. The message volume stayed ‘extremely high.’

A user premised his bullishness on the company confirming the GTA VI Fall launch. They named the stock one of their high-conviction 2025 plays.

Another predicted a $200+ stock price in the coming week.

Take-Two ended Thursday’s after-hours session up 6.29% at $194.60, marking the highest level since Feb. 2021. The stock is down about 0.5% since the start of 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)