Advertisement|Remove ads.

Bill Stock Retreats To 3-Month Low Despite Q2 Beat As Light Guidance Spooks Investors: Retail Sentiment Downbeat

Bill Holdings, Inc. (BILL) shares slumped in Thursday’s after-hours session after the San Jose, California-based company’s fiscal year third-quarter revenue guidance came in shy of estimates. Meanwhile, the second-quarter results exceeded expectations.

The company, which provides a financial operations platform for small and midsize businesses, reported second-quarter non-GAAP earnings per share (EPS) of $0.56, up from $0.51 a year ago, and beating the consensus estimate of $0.47 and the guidance of $0.44-$0.48.

Revenue increased 14% year over year (YoY) to $362.6 million, with subscription revenue rising 7% to $67.7 million and transaction fees increasing 19% to $251.9 million. However, the growth rate slowed from the first quarter.

The top line exceeded the guidance of $355.5 million to $360.5 million and the $360.07 million consensus estimate.

Float revenue, comprising interest on funds held for customers, was $42.9 million.

Among operational metrics, the number of businesses served numbered 481,300 at the end of the second quarter, and the second-quarter total payment volume rose 13% YoY to $84 million. It processed 30 million transactions during the quarter, up 17%

René Lacerte, BILL CEO, said, “We delivered strong financial results and innovated at a rapid pace as we executed on our vision to be the de facto intelligent financial operations platform for SMBs.”

Bill expects third-quarter revenue of $352.5 million to $357.5 million, which suggests a potential growth slowdown to 9%-11%, and non-GAAP EPS of $0..35 to $0.38.

The revenue guidance was shy of the consensus estimate of $360.37 million, according to Yahoo Finance. The bottom line guidance was above the Street estimate of $0.34.

The full-year guidance calls for revenue of $1.454 billion to $1.469 million and non-GAAP EPS of $1.87 to $1.97. This marked an increase from the previous guidance of $1.439 billion to $1.464 billion and $1.65-$1.83, respectively.

Analysts, on average, estimate revenue of $1.46 billion and non-GAAP EPS of $1.78 for the year.

CFO John Rettig said, “We are executing on our strategic priorities and are confident that our strong business model will allow us to drive years of durable growth, an attractive long-term profitability profile, and sustained value generation for shareholders.”

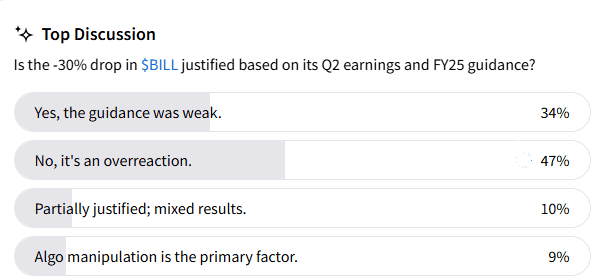

Early results from an ongoing Stocktwits poll showed that 47% of respondents said the post-earnings plunge was uncalled for and was an “overreaction.” Thirty-four percent said conceded that the guidance was weak.

Ten percent said the move was partially justified due to the mixed nature of the results and a more modest 9% said algo manipulator had a role in the stock drop.

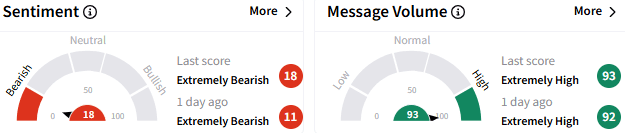

On Stocktwits, sentiment toward Bill stock remained 'extremely bearish’ (18/100) and the message volume stayed ‘extremely high,’

A bearish user said the stock could head toward the 52-week low of $43.

Another user pointed to the elevated P/E levels. The forward P/E for Bill is 57.47, according to Yahoo Finance.

Bill stock fell 29.43% to $68 in the after-hours session, marking the biggest slump in about three months. The stock has added nearly 14% so far this year after reporting a more muted 3.8% gain in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)