Advertisement|Remove ads.

Target Stock Closes Above 200-DMA On Friday: Retail Investors Alert As Sentiment Turns ‘Bullish’

Shares of department store Target Corporation (TGT) are in focus this week after they closed above their 200-day moving average (DMA) on Friday.

Last week, Target shares briefly dipped below the 200-DMA. However, a decent buying support beginning Wednesday pushed the stock back above the crucial average. The rebound comes as a big relief given the fact that when the stock declined below its 200-DMA in August, it took nearly two weeks for the shares to inch-up above the mark.

Some Stocktwits users have spotted the pattern and are expressing optimism on the stock’s trajectory in coming times.

Target is currently trading near the $152 mark and sees a strong resistance at the $180 mark — a level which the stock was unable to clear during its April rally.

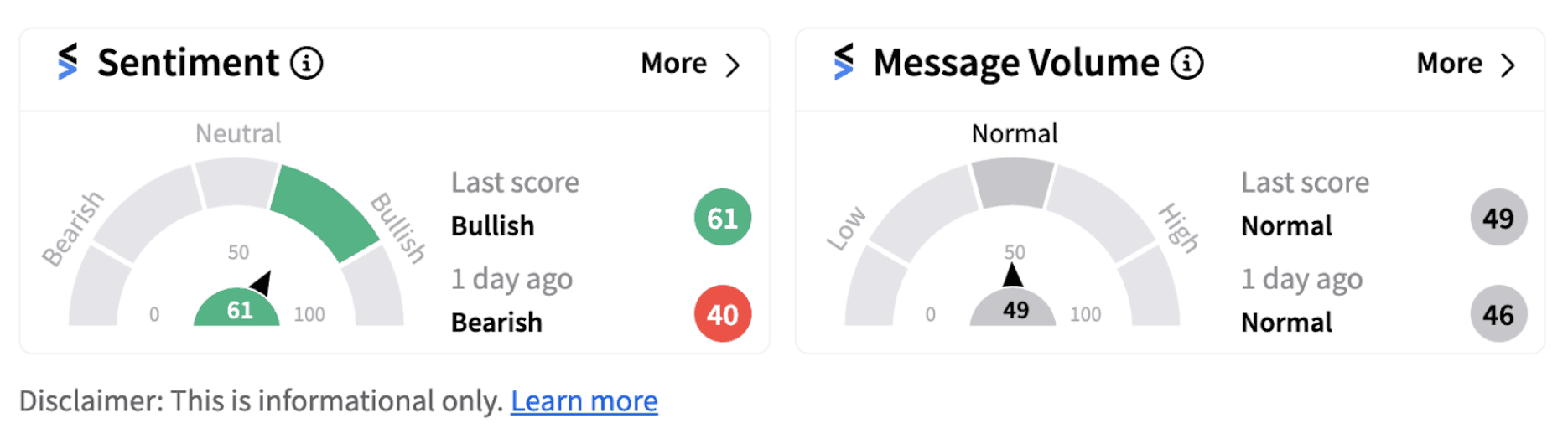

After the stock ended Friday’s session above its 200-DMA, retail sentiment on Stocktwits flipped into the ‘bullish’ territory (61/100) from the ‘bearish’ zone a day ago.

Meanwhile, the firm has announced the Target Circle Week from Oct. 6 to Oct. 12, where it is offering its largest holiday assortment, including thousands of items with more deals and savings.

The firm said it is investing in its existing team and hiring approximately 100,000 additional seasonal team members. Target said that more than half of last year's seasonal team members were offered a position to stay with Target.

Notably, a lot of positives appear to be converging for the department store stock. The company, in its latest earnings report, not only topped analyst estimates on revenue and profit, but also raised its profit guidance.

With the Federal Reserve expected to deliver a rate cut in September and with further rate reductions anticipated in the coming months, retail firms are expected to gain from a potential boost in spending. The only caveat here is that it will be a few quarters before the actual impact of those rate cuts reach the end consumer.

Fundamentals apart, Target stock is also witnessing a positive set of technicals at the current juncture. If the stock manages to sustain above the 200-DMA in the coming days, retail interest in the ticker is expected to see a surge.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)