Advertisement|Remove ads.

Teck Resources Stock Jumps Over 8% Premarket After $53B Mega Merger With Anglo American

U.S. shares of Teck Resources (TECK) gained over 8% in premarket trading after Anglo American agreed to buy the Canadian miner in one of the largest deals in mining history.

According to the terms of the deal, Anglo American shareholders will own 62.4% of the combined company, while Teck holders will hold 37.6%. Each Teck shareholder will receive 1.3301 shares of Anglo American for every share of the Canadian mining firm, representing a 17% premium to Teck’s closing share price on Monday.

However, London-listed Anglo American will also pay its investors $4.5 billion in special dividends before the completion of the deal, expected within the next 12 to 18 months. Anglo American was valued at approximately $36 billion, while Teck’s market capitalization was around $17 billion, based on their last closing prices.

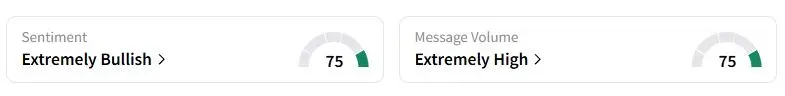

Teck stock was headed to open at its highest since July. Retail sentiment on Stocktwits jumped to ‘extremely bullish’ territory from ‘bullish’ a day ago, while retail chatter also surged.

Both companies have recently been takeover targets, with Anglo American rejecting a $49 billion offer from BHP Group last year, while Teck rebuffed acquisition efforts by Glencore. The megadeal would make Anglo American less vulnerable to takeovers.

The combined company will be known as Anglo Teck Group and will be headquartered in Canada. However, its primary listing will remain in London. Anglo American’s CEO Duncan Wanblad will lead the combined entity, while Teck’s Jonathan Price will serve as deputy CEO.

Teck had produced 446,000 tonnes of copper in 2024, and if the deal goes through, the combined company’s output of the red metal will be well over 1 million tonnes. The Canadian miner is involved in four mining projects, including the giant Quebrada Blanca project in Chile, which is located close to Anglo American’s Collahuasi mine. The two miners expect recurring annual benefits of $800 million following the deal’s close.

Teck, which the founding Keevil family controls, has drawn acquisition interest ever since it sold its coal assets. The family controls Teck through “supervoting” Class A shares.

Canadian minister Melanie Joly said that while she welcomes foreign investment in Canada, the federal government will carefully evaluate employment opportunities, the new global headquarters in Vancouver, and capital expenditures.

Teck’s U.S. shares have fallen 15% this year.

Also See: Why Iris Energy Stock Is Surging 10% Premarket Today

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212700544_jpg_8378e13131.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)