Advertisement|Remove ads.

Tejas Networks Falls To Near 3-year Lows After Third Straight Quarterly Loss

Shares of Tejas Networks slumped nearly 9% to ₹537.05 after the company reported yet another quarterly loss.

Third Straight Quarterly Loss

The company posted a net loss of ₹307.17 crore for Q2, its third successive quarterly loss. It had reported a net profit of ₹275.18 crore last year. Revenue from operations saw a sharp decline of 90.7%, falling to ₹261.37 crore from ₹2,810.14 crore.

The company also reported an EBITDA loss of ₹293.7 crore, reversing from a positive EBITDA of ₹534.45 crore recorded in the year-ago quarter.

In Q2, India contributed 79% and international markets 21% to total revenue. Revenue was impacted by a delay in receiving the BSNL 4G add-on order worth ₹1,526 crore. Additionally, the company booked provisions of around ₹190 crore for manufacturing losses, warranty, and inventory obsolescence.

“In Q2 FY26 we had a revenue of ₹262 crore, a sequential growth of 30%. We ended the quarter with an order book of ₹1,204 Cr. We had a net loss of ₹307 crore, largely due to lower revenue and provisions due to manufacturing process losses, warranty and inventory obsolescence of around ₹190 crore,” said Sumit Dhingra, CFO.

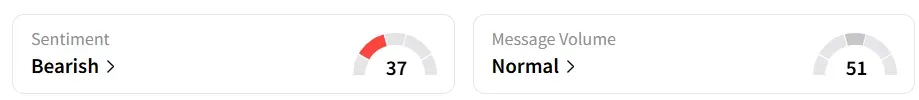

Retail Bearish

Retail sentiment remained ‘bearish’ on Stocktwits. It was ‘neutral’ last week.

Tejas Networks shares reached their lowest levels since February 2023.

The stock has been under heavy selling pressure this year, declining more than 50%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)