Advertisement|Remove ads.

Teradyne’s Stock Jumps After Report Links Its Tech To Amazon’s Vulcan Robot – Retail Turns Bullish

The robotic arms behind Amazon.com Inc.’s (AMZN) new warehouse robot Vulcan’s tactile capabilities are reportedly supplied by Teradyne Inc.(TER), a semiconductor test equipment firm that owns Universal Robots, a Danish company specializing in collaborative robots, or “cobots.”

According to a new investigation by Hunterbrook Media, which partnered with Citrini Research, Teradyne’s role was uncovered.

Following the report, Teradyne stock traded 6.2% higher on Thursday afternoon.

Amazon is touting the new robot as a leap forward in automation, one that allows machines to sense touch and operate with human-like dexterity.

However, Amazon has spotlighted the technology as an in-house milestone. Amazon introduced Vulcan in May as a robot capable of two of the most challenging warehouse tasks to automate, “picking” products from shelves and “stowing” them into bins.

These tasks have historically been performed by human employees due to their complexity and the need for a nuanced sense of touch. Amazon claims Vulcan can now perform them with similar speed and care.

Teradyne’s Universal Robots provides the robotic arm that powers this innovation, easily identified by its signature blue-and-silver design and UR logo, which appears in Amazon’s promotional materials.

The robot’s gripper, branded by Robotiq, is also designed specifically to pair with Universal Robots’ hardware, reinforcing Teradyne’s central role in Vulcan’s engineering.

The report cites UBS, which stated that Amazon could automate up to 80% of the 14 billion items it handles annually with robots like Vulcan. That could generate an estimated $400 million in revenue for Teradyne.

This revelation could also boost Teradyne’s visibility among industrial clients seeking to scale their automation efforts with robotics powered by artificial intelligence.

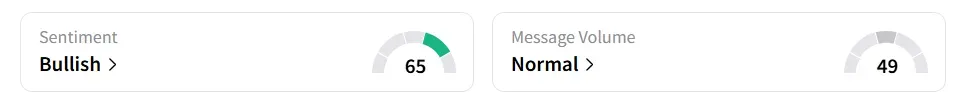

On Stocktwits, retail sentiment toward Teradyne improved to ‘bullish’ from ‘neutral’ territory.

Teradyne stock lost over 21% year-to-date and 38% in the last 12 months.

Goldman Sachs began coverage of Teradyne Inc.(TER) on Thursday with a ‘Sell’ rating and set a price target of $80, as per TheFly.

The research firm described the chip equipment space as being in the middle of its cycle, with a mix of positive and negative forces contributing to relatively steady revenue trends.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)