Advertisement|Remove ads.

Terra Innovatum Stock Pops Over 8% Premarket: Retail Traders Feel Nuclear Play Is Still 'Undervalued'

Terra Innovatum Global stock gained 8.6% in premarket trading on Wednesday, with retail investors debating its valuation compared to peers in the nuclear industry.

Shares of rivals Oklo and NuScale Power rose 7.4% and 5.5%, respectively, as the U.S. Army unveiled plans to build small nuclear reactors at Army bases, in line with President Donald Trump's executive order directing the Army to operate a small nuclear reactor on a domestic base by September 2028.

Terra Innovatum was listed on Nasdaq through a SPAC merger on Friday, joining a handful of companies that are betting on the novel technology.

The firm, founded in Italy, is developing a small reactor that uses standard kinds of nuclear fuel, and management says it can operate continuously at full power for 15 years without refueling.

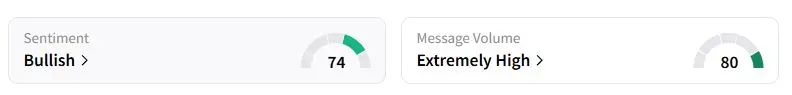

Retail sentiment on Stocktwits about Terra Innovatum was in the 'extremely bullish' territory at the time of writing.

"Anyone who was part of the wild spac runs in 20-21 know[s] these have much more room to run if the market allows," one user said.

Another user highlighted the importance of microreactors to meet A.I. demand while also noting that the company remains undervalued compared to its peers.

U.S. power demand is growing at the fastest pace since World War II, driven by the power-hungry data centers of companies like Meta, Amazon, and OpenAI. According to a report by Deloitte, power demand from AI data centers in the United States is expected to grow more than thirtyfold, reaching 123 gigawatts, up from 4 gigawatts in 2024.

Oklo stock has risen more than eightfold this year, while NuScale stock has more than doubled amid growing optimism around the sector. However, some analysts have warned that most of the reactors are in the development stage, so the companies might find it difficult to justify the lofty valuation in the near term.

Also See: Gold Jumps Past $4,200 On US-China Trade Concerns, Fed Rate Hike Bets

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)