Advertisement|Remove ads.

Tesla Bull Dan Ives Calls On Elon Musk To Leave Government, Become ‘Full-Time’ CEO Of EV-Giant: Retail Stays Bullish Ahead Of Q1 Earnings

Tesla Inc. (TSLA) bull and Wedbush Securities analyst Dan Ives called upon Elon Musk to step back from his role in the Trump administration as head of the Department of Government Efficiency (DOGE) and return to being a full-time CEO at the EV company.

“Musk needs to leave the govt, take a step back on DOGE, and get back to being CEO of Tesla full-time in our view,” Ives said in a post on social media platform X while adding that the first-quarter earnings call on Tuesday will be “big” for the billionaire CEO.

Ives, however, said that he continues to believe Tesla, together with Nvidia, will be “the most disruptive technology companies” over the coming years.

According to a Bloomberg report, Ives said in a report to clients on Sunday that Musk has inflicted brand damage, as evident among car buyers in the U.S., Europe, and Asia.

“Tesla is Musk and Musk is Tesla....,” Ives said, stating his oft-repeated comment on the relationship between the EV brand and its CEO. “Tesla has unfortunately become a political symbol globally of the Trump Administration/DOGE.”

The company faces “potentially 15%-20% permanent demand destruction for future Tesla buyers due to the brand damage Musk has created with DOGE,” according to Ives.

Tesla is set to report its first-quarter earnings after the closing bell on Tuesday. Analysts expect the company's first-quarter earnings per share to decrease to $0.42 from $0.45 a year earlier, and revenue to increase marginally to $21.54 billion, according to FinChat data.

The company reported first-quarter deliveries of 336,681 units, marking a nearly 13% dip from the corresponding quarter of 2024 and representing the company’s worst quarterly performance in at least two years.

Deliveries of the company’s mass-market offerings – the Model 3 and Model Y – fell by 12.4%, while those of its three more premium offerings collectively fell by about 24%

Over a week ago, Wedbush lowered its price target on Tesla (TSLA) to $315 from $550 and maintained an ‘Outperform’ rating on the shares, citing Trump’s tariffs.

Tesla has essentially become a political symbol globally, and that is "a very bad thing for the future of this disruptive tech stalwart and the brand crisis tornado that has now turned into an F5 tornado," the firm then said, according to TheFly.

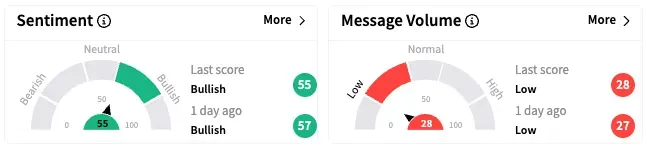

On Stocktwits, retail sentiment around Tesla fell marginally over the past 24 hours but stayed within the ‘bullish’ territory, while message volume remained at ‘low’ levels.

TSLA stock fell by about 41% so far this year but is up by about 59% over the past 12 months.

Also See: Trump Calls Powell a ‘Major Loser,’ Dow Tumbles 650 Points As President Ramps Up Attack On Fed Chair

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2165533708_jpg_f85d1f9870.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_teladoc_logo_resized_f3ec80cc27.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)