Advertisement|Remove ads.

Trump Calls Powell a ‘Major Loser,’ Dow Tumbles 650 Points As President Ramps Up Attack On Fed Chair

The Dow Jones Industrial Average (DJIA) tumbled more than 650 points in Monday morning trade after President Donald Trump ramped up pressure on Fed Chair Jerome Powell, warning the economy could stall without immediate rate cuts.

The Invesco QQQ Trust (QQQ) sank over 2.4%, while the SPDR S&P 500 ETF (SPY) tumbled 2.1%. Meanwhile, the SPDR Dow Jones Industrial Average ETF (DIA) dropped as much as 1.9%.

The losses added to a rocky stretch for equities, with all three indexes down in three of the past four weeks.

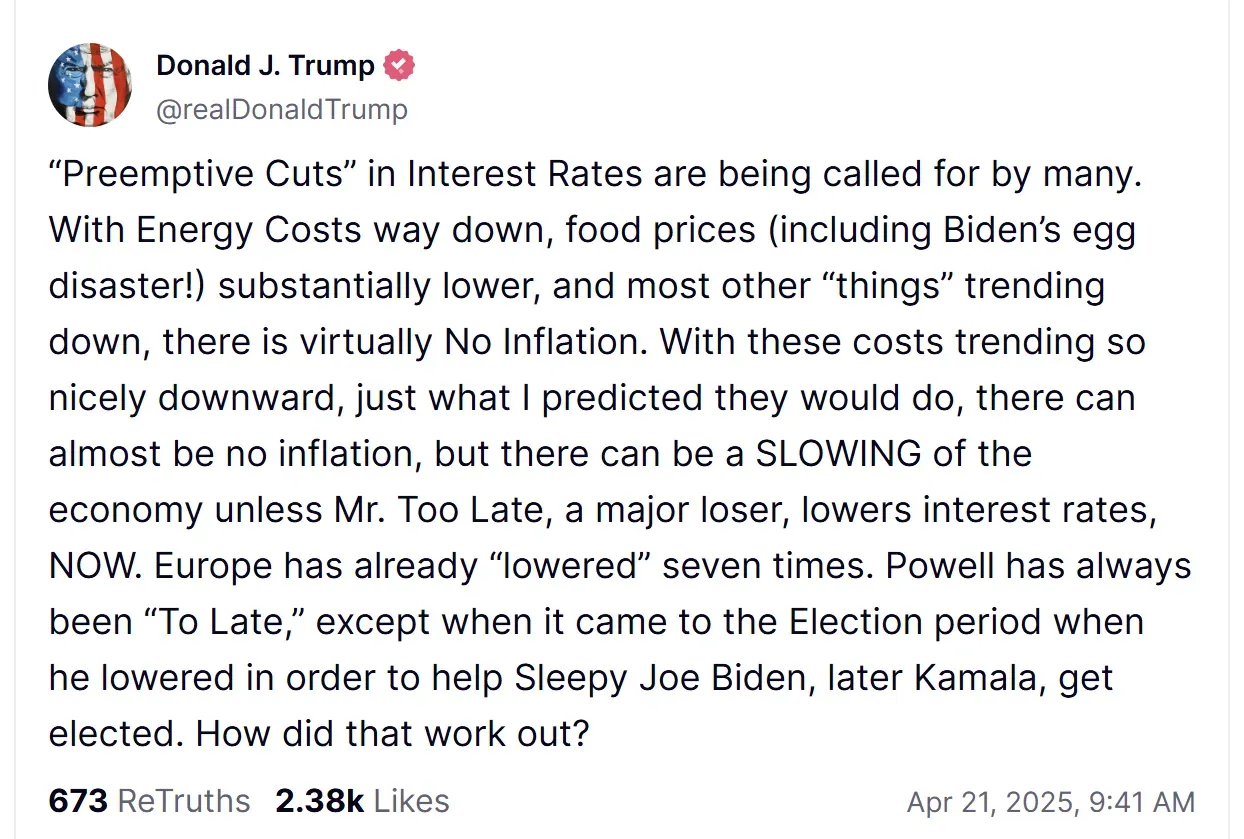

In a Truth Social post, Trump referred to Powell as a “major loser” and accused him of acting too late to mitigate economic risks. “Preemptive cuts in interest rates are being called for by many,” Trump wrote. “There can almost be no inflation, but there can be a slowing of the economy unless Mr. Too Late...lowers interest rates, NOW.”

Trump also suggested that Powell only acted decisively during the 2020 election period to help the then-candidate Joe Biden, adding, “Powell has always been too late, except when it came to the Election period... How did that work out?”

The U.S. Dollar Index (DXY) slipped to 98.30, its lowest level since March 2022, as traders weighed the prospect of increased political pressure on the central bank.

Trump has regularly criticized Powell despite appointing him in 2018. Last week, the President had called for Powell’s removal, a move that White House adviser Kevin Hassett said is being explored.

Evercore ISI Vice Chairman Krishna Guha said Monday the administration could try to influence policy by signaling who it plans to appoint as the next Fed Chair. However, he warned that doing so could destabilize markets. “It’s strongly in the administration’s interest to let Powell run things through the remainder of his term,” Guha explained during a CNBC interview.

Senator Elizabeth Warren added her own warning last week, saying markets would “crash” if Trump removes Powell, arguing it would threaten the Fed’s independence and likening such a move to the behavior of “a two-bit dictatorship.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Gold Hits $3,400 As US Dollar Weakens, Trade Uncertainty Grows

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)