Advertisement|Remove ads.

Tesla Is Losing Ground In Europe Even As EV Demand Accelerates

- From January through December, Tesla’s European registrations dropped around 27% to 238,656 units.

- In the European Union (EU) alone, Tesla’s new registrations declined nearly 32% in December.

- BYD reported 27,678 new registrations in December, a 230% increase from the previous year.

Tesla Inc.’s (TSLA) European challenges intensified in December, as fresh data from the European Automobile Manufacturers’ Association (ACEA) showed a sharp decline in registrations despite a booming electric vehicle (EV) market. Its shrinking market share adds to concerns about competitive pressures heading into 2026.

Tesla recorded 35,280 new registrations during the month, down 20% year over year from 44,190 units. This underperformance stood in stark contrast to the broader battery-electric vehicle (BEV) market, where registrations surged 50.3% to 308,955 units. As a result, Tesla’s BEV market share fell to 11.4%, nearly halving from 21.5% a year earlier.

The weakness was even more pronounced over the full year. From January through December, Tesla’s European registrations dropped around 27% to 238,656 units.

Chinese Competitors Hurt Market Share

Meanwhile, competition from China continued to gain ground. BYD reported 27,678 registrations in December, marking a remarkable 230% increase from the previous year. For full-year 2025, BYD’s European registrations jumped to 187,657, up from just 50,912 in 2024.

SAIC also reported solid growth. New registrations in December rose more than 15% year over year to 31,806 units, while full-year registrations climbed 25% to 305,717.

In the European Union (EU) alone, Tesla’s new registrations declined nearly 32% in December and 38% in 2025. Overall, new car registrations in the EU edged up by 1.8% in 2025, but volumes remain well below pre-pandemic levels. Battery-electric vehicles captured a 17.4% share of the market.

Globally, BYD sold 2,256,714 battery-electric vehicles in 2025, overtaking Tesla’s 1,636,129 units for the first time, according to a CnEVPost on Tuesday.

Stock Watch

TSLA stock was up 0.6% in pre-market trading on Tuesday, having closed 3% lower in the previous session. Tesla’s Director of Vehicle Operations and Engineering at Fremont, Benjamin Bate, reportedly left the company to join Chemelex, marking another senior departure, adding to a growing list of high-profile leadership changes at Tesla over the past two years.

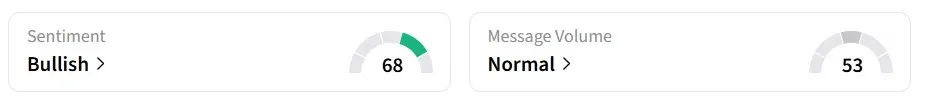

Retail sentiment on Stocktwits remained in bullish territory over the past 24 hours.

The stock is up more than 10% over the past year, though it has slipped about 4% so far in 2026.

Read also: UNH Stock Slides Pre-Market: United Health Warns Of Softer FY26 As Medicare Pressures Mount

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_8bc1596785.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)