Advertisement|Remove ads.

UNH Stock Slides Pre-Market: United Health Warns Of Softer FY26 As Medicare Pressures Mount

- The insurer reported a 12% increase in Q4 revenue at $113.26 billion, marginally below street estimates of $113.73 billion.

- FY2025 adjusted medical care ratio rose to 88.9% from 85.5% in 2024, driven by Medicare funding cuts.

- BofA maintained a ‘Neutral’ rating and a price target of $360.

UnitedHealth Group Inc (UNH) stock slid 16% in pre-market trading on Tuesday after the company issued a weak full-year (FY) 2026 outlook, following a soft fourth-quarter (Q4) print, which came in slightly below Wall Street estimates.

UnitedHealth expects 2026 revenue of around $439 billion, a 2% year-over-year decline, as the company undertakes planned right-sizing across the enterprise.

The insurer reported a 12% increase in Q4 revenue at $113.26 billion, marginally below street estimates of $113.73 billion, according to Fiscal.ai data. Adjusted earnings per share (EPS) for Q4 came in line with estimates of $2.11.

Higher Expenses

The full-year 2025 adjusted medical care ratio (MCR) rose to 88.9% from 85.5% in 2024, driven by Medicare funding cuts, impacts from the Inflation Reduction Act, and higher medical costs. The MCR represents the share of revenue spent on medical claims; a higher ratio indicates that costs are rising faster than revenue.

FY2025 operating earnings of $19 billion included a $2.8 billion charge for cyberattack costs, divestitures, restructuring, and related actions, the company added.

Shares of UnitedHealth were already under pressure after the Centers for Medicare and Medicaid Services (CMS) proposed a nearly flat increase in Medicare Advantage payments for next year. The agency projected a 0.09% average increase for CY 2027, well below the 4 - 6% rise analysts had expected.

CMS Notice Is Stock’s Primary Trigger For Decline

BofA said that UnitedHealth’s Q4 EPS and 2026 guidance signals that the company’s turnaround is “on track,” according to The Fly. The brokerage sees the $17.75 EPS guidance as a baseline for 2026, with modest upside expected.

However, the firm highlights that CMS’s 2027 Advance Rate Notice came in well below expectations, and “V29” risk adjustment changes could slow the rebound of Medicare Advantage and Value-Based Care, calling this the main reason for the stock’s decline.

BofA maintained a ‘Neutral’ rating and a price target of $360, awaiting more clarity on V29 for 2027 and beyond.

Technical Analysis

After nine months, UNH stock had inched above the 200-day moving average (DMA) in January 2026 and has since hovered near it. However, the stock is likely to fall back below this key long-term indicator again if premarket losses hold.

Retail Reaction

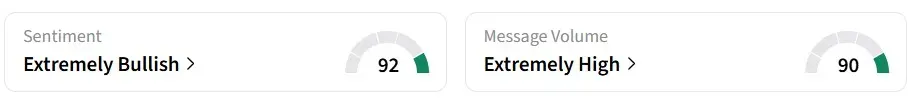

Despite the sharp premarket decline, retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘extremely high’ message volumes. UNH was the top trending ticker on the platform at the time of writing.

One user weighed the company's 2026 outlook against the CMS guidance.

Another user saw support in the $290-$292 zone. It is currently at $298.

The stock has declined around 35% over the past year.

Read also: Tesla Is Losing Ground In Europe Even As EV Demand Accelerates

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)