Advertisement|Remove ads.

Tesla Reportedly Commences Production Ramp-Up At Its Shanghai Gigafactory

Tesla (TSLA) shares traded near 2% higher in Monday’s pre-market session after a report indicated that the EV giant’s gigafactory in China has reportedly commenced a ramp-up in production.

According to a Reuters report on Monday, citing company executive Tao Lin, the factory began production ramp-up in the fourth quarter. The news comes on the heels of data showing that the company’s EV sales in China rose 25% in September as compared to August.

Tesla sold 71,525 vehicles in China in September, making it the firm’s second-best month of the year, behind only March. Including exports, Tesla China’s wholesale sales totaled 90,812 units last month, marking a growth of 2.8% year-over-year.

Tesla makes its best-selling Model Y and Model 3 vehicles at its Shanghai gigafactory for sales in the country and export to certain international locations. The factory has a current installed annual vehicle capacity of over 950,000 vehicles, exceeding the capacity of the company's other factories, including those in California, Berlin, and Texas.

In January, Tesla launched the refreshed Model Y in China in a bid to boost sales numbers. In July, Tesla also said that it is continuing to prepare for the broader release of its full self-driving driver assistance technology in China this year, pending regulatory approval.

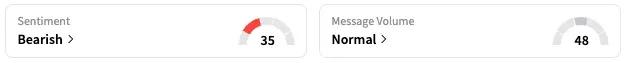

On Stocktwits, retail sentiment around TSLA stock stayed within the ‘bearish’ territory over the past 24 hours, while message volume stayed at ‘normal’ levels.

A Stocktwits user expects the shares to touch $440 on Monday.

Tesla must deliver over 570,000 vehicles in the fourth quarter to avoid a year-on-year drop in deliveries for the full year. However, Tesla has not delivered over 500,000 vehicles in a quarter, making this an ambitious target.

TSLA stock is up by 2% this year and by about 89% over the past 12 months.

Read also: Vertiv Stock In Spotlight After Company Names Craig Chamberlin As CFO

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)