Advertisement|Remove ads.

Tesla Stock Rises After-Hours As Trump Says His Tax Bill Makes Made-In-America Cars Affordable: ‘You’re So Lucky I’m With You Elon’

- Trump promoted his new tax package, saying its loan-interest deduction will significantly boost affordability for U.S.-built vehicles.

- The policy shift comes weeks after federal EV credits expired, prompting Tesla to increase lease prices on key models.

- Musk’s return to the White House added a political backdrop to Trump’s remarks as Tesla continues navigating margin pressure and higher costs.

Tesla, Inc. shares rose in after-hours trading on Wednesday after U.S. President Donald Trump said his new tax package will make American-made cars more affordable, telling CEO Elon Musk he is “so lucky” to have his support. Trump promoted the Republicans’ “Big, Beautiful Bill,” saying the measure gives middle-income buyers meaningful relief if they want to purchase what he called “a nice Tesla car.”

Loan-Interest Deduction Cast As Big Lift For Auto Demand

At the center of the bill is a temporary income-tax deduction of up to $10,000 for interest paid on personal vehicle loans. Trump described it as a major boost to affordability and overall demand, saying the ability to deduct interest would be “an unbelievable boon to car sales.”

He joked that Musk might prefer a policy that applies only to Tesla, but said the deduction would remain available to all U.S.-assembled vehicles. Trump also reiterated his broader stance that “everybody has to have an electric car by 2030,” positioning the deduction as part of the country’s EV transition.

Expiration Of EV Tax Credits

Trump’s remarks come weeks after the Sept. 30 expiration of federal EV tax credits that offered consumers $7,500 toward new electric vehicles and $4,000 toward used models. Following the expiration, Tesla raised lease prices on its Model Y and Model 3 in the U.S., with monthly increases of roughly $50 to $80. The phaseout of the credits earlier this year drove buyers to accelerate purchases, creating a pull-forward effect that lifted Tesla’s delivery totals.

Credit Rush Reflected In Tesla’s Q3 Print

Tesla’s earnings report showed how the pre-expiry credit rush supported Q3 volumes. Deliveries rose to 497,099 vehicles, helped by buyers seeking to secure the outgoing federal incentive. Revenue increased 12%, but profitability was pressured by higher operating expenses, rising costs and U.S. tariffs. Automotive gross margin, excluding regulatory credits, fell to 15.4%, and the company said tariffs added about $400 million in quarterly costs.

Musk’s Return To White House

Trump’s remarks came as Musk returned to the White House after months of strained relations. Musk attended a gala honoring Saudi Crown Prince Mohammed bin Salman, joining business leaders including Tim Cook, Jensen Huang, and Bill Ackman. The event followed a turbulent period marked by disagreements over an earlier budget and tax-cut package, and arrived weeks after Tesla shareholders approved Musk’s $1 trillion compensation package. Musk’s renewed engagement in Washington also drew attention to the administration’s discussions about limiting the influence of proxy advisers and index-fund giants, an issue he regularly criticized during the compensation vote fight.

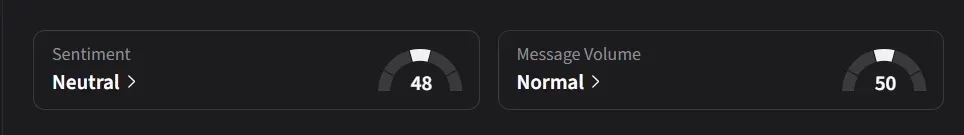

Stocktwits Traders See Big Upside

On Stocktwits, retail sentiment for Tesla flipped ‘neutral’ from ‘bearish’ on Wednesday amid ‘normal’ message volume.

Users expect a move toward $410-$430 in the near term, with some traders even targeting $450 and others aiming for a return to $480, implying upside of roughly 2%-19% from the current price of $403.99.

Tesla’s stock is nearly flat so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1157193929_jpg_57df32610c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)