Advertisement|Remove ads.

Tesla Stock Rises Pre-Market After UBS Raises Q3 Delivery Estimate, Mizuho Hikes Price Target

UBS expects EV giant Tesla's (TSLA) third-quarter (Q3) deliveries to be 475,000, which is 8% above consensus.

The analyst had previously estimated Tesla to report Q3 deliveries of just 431,000 units. Notably, in the third quarter of 2024, Tesla reported 462,890 vehicle deliveries.

For the fourth quarter, however, UBS expects Tesla’s deliveries to decline 14% year-over-year to 428,000 units, according to TheFly. The firm has a ‘Sell’ rating on Tesla and $215 price target on the shares, representing a downside of above 50% from the stock’s last closing price of $434.21.

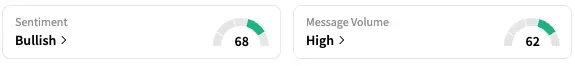

Tesla stock traded 1% higher in the pre-market session at the time of writing. On Stocktwits, retail sentiment around TSLA fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours, while message volume stayed at ‘high’ levels.

A Stocktwits user warned against shorting the stock.

Tesla reported a year-on-year decline in vehicle deliveries in both the first and second quarters of this year. In the second quarter, through the end of June, the company reported deliveries of 384,122 units, marking a 13.5% year-on-year decline.

In the first quarter, Tesla reported deliveries of 336,681 units, marking a dip of nearly 13% from the corresponding quarter of 2024 and the company’s worst quarterly performance in at least two years.

However, Tesla is currently attempting to pivot away from being merely an EV maker with investments in AI and robotics, including robotaxis and humanoid robots. Earlier this month, Tesla CEO Elon Musk also acquired 2.57 million shares of the company in the open market for approximately $1 billion.

Separately, Mizuho on Tuesday raised its price target on Tesla to $450 from $375 while keeping an ‘Outperform’ rating on the shares, citing the rise in electric vehicle sales in the U.S. in August ahead of the expiration of the federal tax credit on the purchase of new EVs slated for September 30.

TSLA shares are up by about 8% this year and by about 74% over the past 12 months.

Read also: Boeing Proposes Remedies As It Seeks EU Green Light For Spirit AeroSystems Deal: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)