Advertisement|Remove ads.

This Smallcap Chemical Stock Could See Over 10% Rally In Next Three Months: SEBI RA Varunkumar Patel

JG Chemicals shares hit a 52-week high on Monday, surging 15% intraday. The stock has seen a 40% rally over the last month, displaying strong bullish signals on the technical charts, supported by robust underlying fundamentals and a favorable setup for potential upside.

According to SEBI-registered analyst Varunkumar Patel, the stock is displaying a bullish trend by trading above all key moving averages, with the 20-day Exponential Moving Average (EMA) at ₹447.91, 50-day EMA at ₹447.12, and 200-day EMA at ₹434.93.

Patel has set a price target of ₹590 in the next three months, while adding a stop loss at ₹375.

At the time of writing, the JG Chemcials’ stock surged 13.5% higher to ₹527.70.

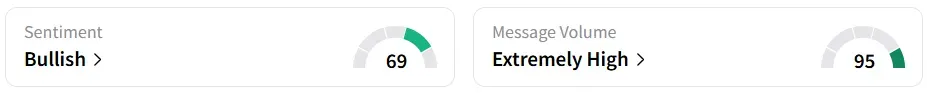

Retail sentiment on Stocktwits changed to ‘bullish’ from ‘extremely bullish’ a week ago, amid ‘extremely high’ message volumes.

Year-to-date (YTD), the stock has surged nearly 30%.

Fundamentally, the stock has posted strong quarterly and yearly results, with a 23.7% increase in Q4 FY25 revenue and a 17.3% rise in net profit. For FY25, revenue jumped 27% to ₹847.9 crore, and net profit more than doubled to ₹64.02 crore.

Its P/E stands at 28, compared to the sector average of 43. Risks include margin pressure and commodity price swings, but the overall outlook remains optimistic, the analyst added.

JG Chemicals is India’s largest manufacturer of zinc oxide, accounting for nearly 30% of the domestic market and ranking among the top five globally. Its products cater to a wide range of industries, including rubber, pharma, ceramics, electronics, and cosmetics, among others.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)