Advertisement|Remove ads.

Thor Industries Stock Soars As Company Reports Upbeat Q1, Reaffirms FY25 Guidance: But Retail Sees Shares Slip To $75-$80 Levels

Shares of THOR Industries, Inc. (THO) traded 4% higher on Wednesday afternoon after the company’s third quarter earnings exceeded Wall Street estimates, with the firm reaffirming its fiscal 2025 financial guidance.

The recreational vehicles (RV) manufacturer’s consolidated net sales in the quarter jumped 3.3% to $2.89 billion, exceeding an analyst estimate of $2.60 billion, according to Finchat data.

The rise in revenue was owing to a surge in sales across its North American Towable RVs and North American Motorized RV segments, which offset a 5.1% drop in sales of European RVs. Sales of North American Towable RVs jumped 9.1% to $1.17 billion in the quarter.

Diluted earnings per share for the third quarter of fiscal 2025 was $2.53, compared to $2.13 for the third quarter of fiscal 2024. This exceeded an analyst estimate of $1.8.

CEO Bob Martin said that the company’s third quarter results exceeded his expectations but warned that the company expects the fourth quarter of fiscal 2025 and the first quarter of fiscal 2026 to be “challenging.”

“The current economic uncertainty has led to downward pressure on consumer confidence and has negatively impacted retail pull-through. We believe that upon the resolution of this uncertainty, we will see improved consumer confidence and the return of a strong retail environment. In the meantime, we will continue to execute the strategies necessary to maximize our performance in the given market conditions,” he said.

For full year fiscal 2025, Thor sees consolidated net sales in the range of $9.0 billion to $9.5 billion, consolidated gross profit margin in the range of 13.8% to 14.5%, and diluted earnings per share in the range of $3.30 to $4.00.

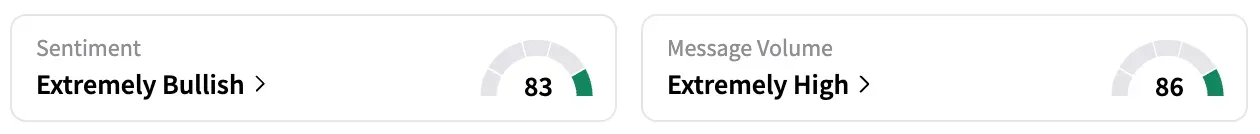

On Stocktwits, retail sentiment around Thor jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user, however, expressed concerns about the possibility of the stock drifting back to $75-$80.

According to data from Koyfin, nine of 16 analysts covering the stock rate it a ‘Hold’, four rate it ‘Buy’ or higher, while three rate it ‘Sell’ or ‘Strong Sell.’ The stock has an average price target of $86.5.

THO stock is down 9% this year and approximately 11% over the past 12 months.

Read Next: Trump’s Tax Bill To Add $2.4 Trillion To Deficit, Not $3.8 Trillion, Says CBO

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)