Advertisement|Remove ads.

Tonix Pharmaceuticals Stock Jumps Into Retail Spotlight After $25M Buyback Boost — Traders See ‘Blueprint For Rerating’

- Retail traders pointed to the expanded buyback authorization as a sign of management confidence, framing it as a potential catalyst for renewed valuation upside.

- The commercial rollout of Tonmya and buyback progress strengthened bullish sentiment around the company’s turnaround.

- Some users speculated that the larger repurchase program could pressure short sellers or even hint at early buyout interest.

Tonix Pharmaceuticals stock moved into sharp retail focus on Tuesday after the company expanded its share repurchase authorization by an additional $25 million, bringing the total buyback capacity to $35 million. The move came just one day after Tonix launched Tonmya, its newly approved fibromyalgia treatment, into U.S. pharmacies.

Buyback Expansion Sparks Bullish Retail Reaction

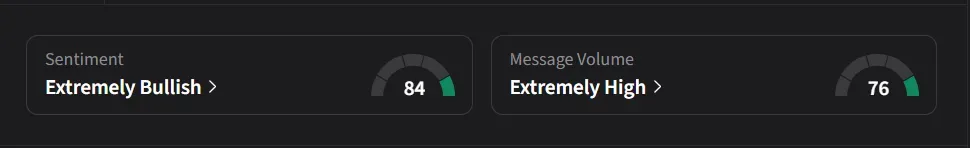

On Stocktwits, retail sentiment for Tonix was ‘extremely bullish’ amid ‘extremely high’ message volume.

In an 8-K filing on Tuesday, the company approved the increased buyback authorization, a signal retail traders interpreted as management showing confidence in Tonix’s valuation. One user said the upbeat tone of the filing, combined with clear progress on the Tonmya rollout, created a “blueprint for a rerating,” adding that companies don’t authorize larger repurchases unless they believe the stock is undervalued.

Another user highlighted Tonix’s turnaround, noting that investors who bought shares before FDA approval and commercialization were taking on significantly more risk. “we now have a FDA approved product, more cash than MCAP, huge pipeline, commercialization, grants, fast track designation, increased share buyback and many more,” the user said.

Short-Squeeze And Buyout Speculation Emerges

The buyback news also triggered speculation about pressure on short sellers. One retail trader suggested that repurchases could force shorts to compete for shares, saying the company’s decision signaled it was “done with ATM dilution.”

Another argued the enlarged buyback could “equal huge short squeeze,” while a separate user linked the authorization to potential M&A interest, saying a repurchase program “makes sense if you’re being contacted about a buyout.”

Tonmya Launch Adds Momentum

Tonix began commercial distribution of Tonmya on Monday, a prescription, non-opioid bedtime tablet approved for treating fibromyalgia in adults. The company said the drug is now available in U.S. pharmacies, calling the launch a “momentous day” for the estimated 10 million Americans living with fibromyalgia.

The treatment received FDA approval in August based on two Phase 3 trials involving nearly 1,000 patients, which demonstrated reductions in daily pain and improvements in sleep, fatigue and overall functioning over 14 weeks. Side effects were mostly mild, including drowsiness, dry mouth and temporary oral numbness.

Tonix’s stock has slumped 51% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)