Advertisement|Remove ads.

Topgolf Callaway Stock Drops On Q1 Results, Weakness In Golf Venue Unit: Retail Retreats

Topgolf Callaway Brands (MODG) shares fell 17% on Tuesday after the golf equipment company's mixed results.

Revenue in the first quarter was down 4.5% to $1.09 billion due to reduced same-venue sales at its biggest business unit, Topgolf, and a strategic downsizing of the Jack Wolfskin business.

The figure was, however, above the analysts' estimate of $1.07 billion from FactSet.

Adjusted profit rose to $0.11 per share, up from $0.08 a year earlier, and was also above the estimate of $0.06.

The company maintained its full-year outlook but lowered the sales estimate for its Topgolf entertainment business. Same-venue sales at the unit are now expected to decline 6% to 12% this year, compared to its previous forecast of a mid-single-digit drop.

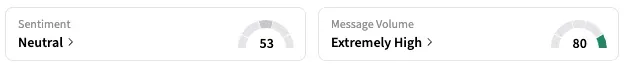

On Stocktwits, the retail sentiment dropped to 'neutral' from 'bullish' the previous day.

One user said they "don’t see this staying down for long, especially with the spin off coming!"

In September, Topgolf Callaway Brands announced plans to split into two standalone companies by the second half of 2025, in a move aimed at sharpening focus across its core businesses.

Under the proposed separation, Callaway will concentrate on golf equipment and apparel, while Topgolf will center on its entertainment venue operations.

Topgolf Callaway shares are down 16.7% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)