Advertisement|Remove ads.

Toyota Expects 21% Profit Decline In FY26: Retail’s In Wait-And-Watch Mode

Japanese automaker Toyota Motor (TM) expects operating income for fiscal year 2026 to fall 21% year-on-year to 3,800 billion yen ($26.25 billion), owing to factors including U.S. tariffs on vehicle imports.

The company said that the new forecast includes a negative impact of 180 billion yen from U.S. tariffs for April and May, and an estimated 745 billion yen from the effects of the foreign exchange rate.

The carmaker expects revenue to rise 1% to 48.5 trillion yen in FY26 due to higher retail vehicle sales. However, the impact of U.S. tariffs and other factors has made it difficult to anticipate the business outlook, the company said.

For the fiscal year ending March 2025, the company reported total sales revenue of 48,036.70 billion yen, marking a growth of 6.5% YoY, and above an analyst estimate of 47.67 trillion yen, per Finchat data.

Operating income, however, fell 10.4% to 4,795.59 billion yen during the fiscal year, particularly owing to a 78.5% drop in operating income to 108.8 billion yen in North America during the period.

Operating income in Japan, the company's home country, also fell 9.6% in the fiscal year to 3,151.1 billion yen.

Earnings per share for the year subsequently fell to 359.56 yen from 365.94 yen in FY24, above an estimated 338.46 yen.

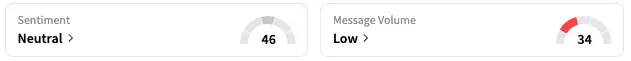

On Stocktwits, retail sentiment around Toyota stayed unmoved within the ‘bullish’ territory over the past 24% hours while message volume remained at ‘low’ levels.

TM stock is trading 2% lower in pre-market on Thursday.

The stock has been down by over 2% year-to-date and by nearly 19% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange Rate: 1 Japanese Yen = 0.0069 USD)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)